Modern Living Sonoma reflects on 2021 and looks forward to 2022 with a new team member and new ideas for blog posts.

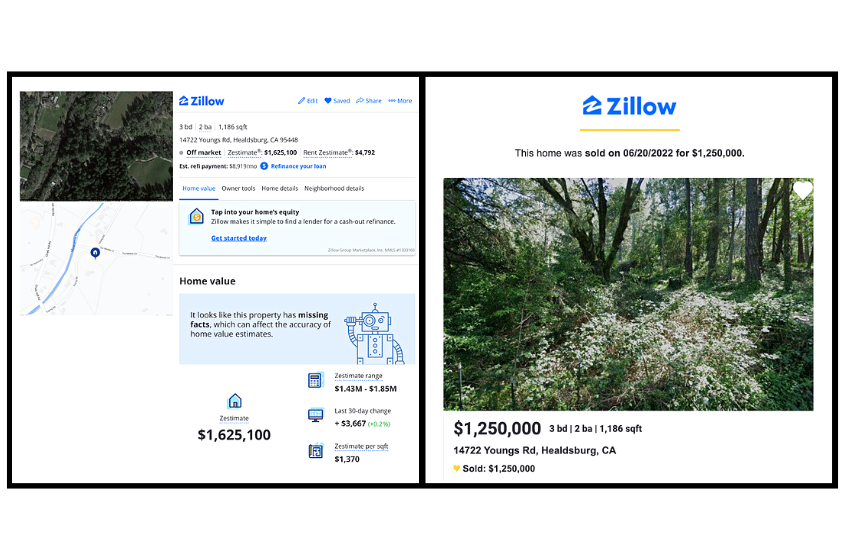

When I sold my home in Alexander Valley last year, the Zestimate showed it as being worth $1.625m, I put it on the market for $1.2m and sold it for $1.25m within a week. I guarantee if that was a client’s home, the seller would have come to me saying they thought the house was worth $1.65m to $1.7m. I would have told them it wasn’t and then one of two things might happen: 1) I managed to convince them using the available data that it was worth closer to $1.2m or 2) another agent would have told them they could sell it for $1.7m and it would still be on the market. So why are Zestimates from Zillow or Redfin’s estimates so often so wrong?

Websites like Zillow and Redfin use automated algorithms known as AVMs to estimate home values. These algorithms rely on various data sources and statistical models but they don’t have an understanding of the full context of the property or its unique features. The area where these algorithms are most accurate is when you have two homes in a subdivision of cookie-cutter homes where all the homes have the same layout and so the only variances are in decor and whether a kitchen has been remodeled. Even then, two homes, that appear identical in the eyes of the AVM can vary by $50-$100k which is a material difference.

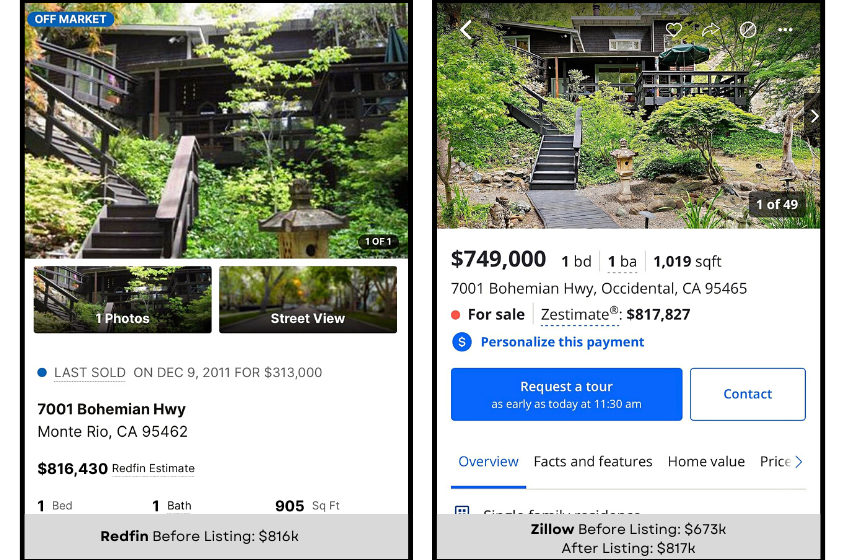

We just listed a home in Occidental, 7001 Bohemian Hwy for $749,000. Prior to us putting it on the market, Zillow estimated its value at $673k while Redfin estimated its value at $816k. Now we have listed it for $749k Zillow has adjusted its valuation to $817k, within $1000 of the original Redfin estimate. In this instance, this should actually help us push the price up because I guarantee any buyer will look to see what some of the AVMs value the property at. Sadly it doesn’t always work like that. In some cases, these valuation engines actually cost homeowners real money by depressing the perceived value of a home.

AVMs rely on data from public records such as tax assessments and previous sales data so the estimate is only as good as the data that the algorithm relies on. It isn’t unusual for tax records to misstate the number of bedrooms or bathrooms or even not have the correct square footage for the property. This is particularly true where there has been a recent improvement in either adding square footage or if there is additional living space that isn’t permitted but still adds value to the property.

This is one of the biggest areas where the AVMs fall down because unless there is recent sales data to support an increased valuation, two homes that are identical in every way, except for the fact that one has been recently been entirely remodeled and the other one is in original condition, will be valued the same despite the fact that one has been improved by hundreds of thousands of dollars.

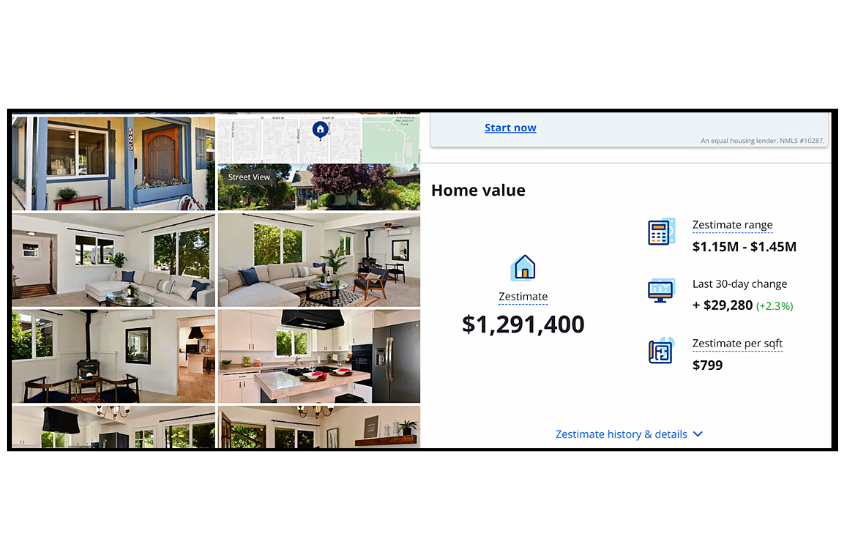

For example, the home that I currently live in, I bought 3 years ago for $850k and spent a few hundred thousand remodeling it. If I look at Zillow it shows it has a value of $1.291m

However, this valuation is not only based on incorrect data, it has 2 bathrooms, not 3 but also it takes no account of the fact that the house has been remodeled from top to bottom. The fair market value for the home is nearer $1.7m. However, if I put this on the market for $1.7m and potential buyers saw the Zestimate, they would probably think I was charging too much

At the most basic level if we take two homes with identical square footage but one home is a single-level home and one is a two-story home, you can expect the single-level home to sell for a premium. However, the impact of floor plans and property layout on price is also a lot more subtle than that. If we take two identical homes and one home has opened up the kitchen dining area and the other still has the downstairs divided into a separate kitchen, dining, and living room, the open plan home will command a premium

If we take any two homes that look very similar on paper, the home with the more efficient floor plan will always command a premium via a higher $ per sq ft. Not all square footage is equal in terms of functionality and usable space. Homes with large hallways, staircases, or other areas that are not considered livable may inflate the price per square foot without providing practical value.

Another factor which throws off estimates that come from websites such as Redfin and Zillow is land values. Because these algorithms are heavily weighted towards $ per sq ft if there is a 1200 sq ft 2 bed 2 bath home on twenty acres of planted vineyard, Zillow will almost certainly undervalue it because it will not attribute enough value per acre of planted vines which can easily bring $100k per acre to the value of the property.

In many markets, there is huge price sensitivity based on some very specific roads. Two identical properties can be on adjacent roads but have different values. One example I would use is a house one road north of Powell St in Healdsburg versus a home one road south of Healdsburg. There can be as much as a 20 percent difference in the price because of the perception that being south of Powell St makes the house “within walking distance of the Plaza” versus the other house with is in midtown because it is a couple of roads over.

Another good example is the difference in price between a lakefront property and an identical property that is not on the lake. For example, we sold 9352 Lakewood Dr which is in Windsor’s Lakewood development which sold for $1.6M. This property was a perfect example of a huge premium for the lake setting on one of the best three lots in the community. This would probably have sold for between $1.25m and $1.3m if it was not on the lake indicating the lakefront location adds 23% to the overall price. That is definitely not something that would be reflected in the Zestimate.

We also recently sold a condo in Lakewood, 9448 Lakewood Drive, which was right on the lake. This closed for $839,000 compared to a similar unit that was not on the lake which would likely close for around $750k right now indicating a premium of 12% for a condo.

As with any market, supply, and demand is the single biggest factor in pricing. One good example of this is driven by the restrictions that are put on homes when it comes to being able to vacation rent them or not. In Sonoma County, because various areas are in an exclusion zone where homeowners are not allowed to vacation rent their homes, this creates a higher demand for homes that are just outside of these zones.

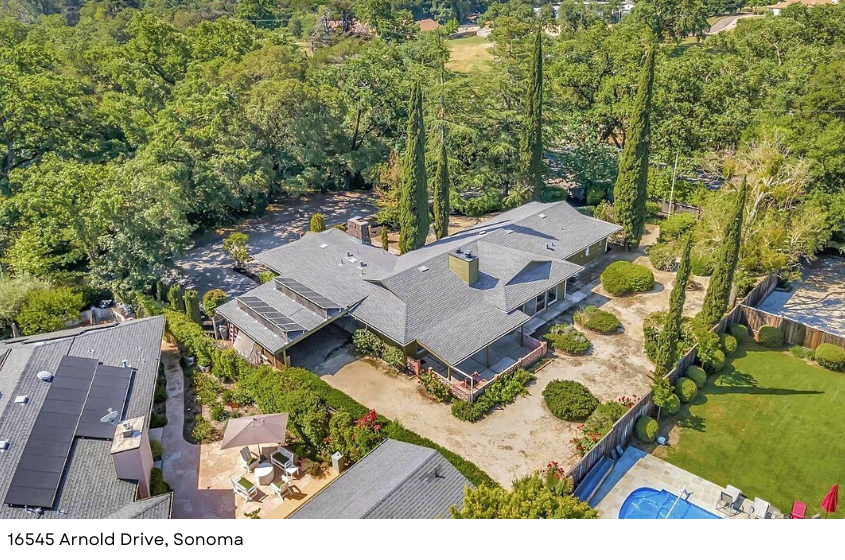

For example, there was a home on Arnold Drive that come on the market a couple of weeks ago. Arnold Drive is one of those areas which is close to Sonoma but is outside of the exclusion zone.16545 Arnold Drive is sandwiched in between two exclusion zones (marked by the red dotted line). One of the single biggest reasons this home got so many offers and why it got bid up to $1.3m from its asking price under $1.1m is because of the ability for a home buyer, most likely a second home buyer, to have the option to also vacation rent it when there were not using it themselves.

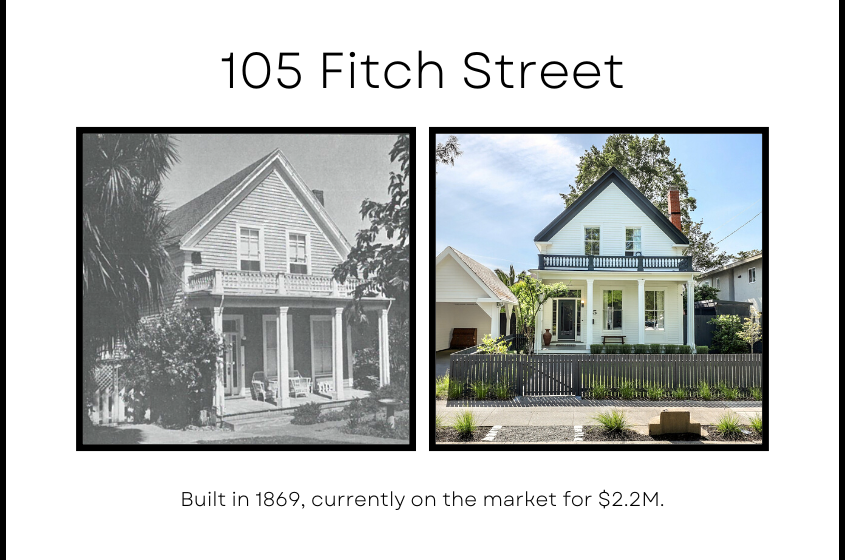

Another factor that distorts home prices on a site like Zillow is properties that have specific historical significance. For example in Healdsburg, there are specific downtown areas where homes are designated of historical significance. The actual premium is harder to quantify but given that a large part of a purchase is about the emotional connection with the buyer, a property with a story will likely attract more interest from buyers and so increase the price.

Early this year I sold a property in Healdsburg, 105 Fitch St, which was one of the oldest homes in Healdsburg. It is one of a number of homes that are actually on a historic home tour in Healdsburg. Time and again we see homes in Healdsburg which date back to the early part of the 20th century command a premium to a buyer who wants to buy it and lovingly restore it. Even for a home that needs significant improvements, a home of this type can often get a $ per sq ft price closer to a non-historic home that has been upgraded.

If we take two newly built homes that are identical on paper and one is a super modern architecturally significant home, built from steel and glass designed by a known architect, and the other is a new home built in a Tuscan style, the home with the modern aesthetic will be worth significantly more every time.

It is hard to come up with a rule of thumb for what the premium is but the fact that there are probably one hundred times the number of people who would choose a modern home over a home that was in the style of a Tuscan villa gives you an indication of the likely different in price. The AVMs have no way of making this distinction in the relative appeal of different styles of homes.

If you are looking to sell your home and you have looked at what Redfin or Zillow says it is worth then don’t expect it to be right! You might have the type of home where the AVM gives exactly the same answer as a realtor but that is more likely to be a happy coincidence than the data science behind the AVM

The best thing you can do is talk to a realtor who knows the area inside out to tell you what it is worth. The worst thing you can do is ignore the valuation they give you. If you think the AVM is right, you will almost certainly lose out in the long run because you will put the home on the market for too high a price, it will sit on the market for 90+ days, and you will have to do a price reduction and you will likely end up at a lower price than the price the realtor suggested in the first place.

Office

Essentials

Consumer Protection & Privacy

© 2025 All rights reserved

Created with Placester

Sign in with your email address

Enter your email address

Please wait...