Last month the Federal reserve announced that it is holding rates for the moment but also that it has no immediate plans to cut interest rates though 2024 although there may be one cut if the inflation numbers keep in check. This is good news but it also isn't going to set the buyer market alight! But how is this impacting the market? For sellers and for buyers? Is now a good time to sell? Or a good time to buy if you have been looking?

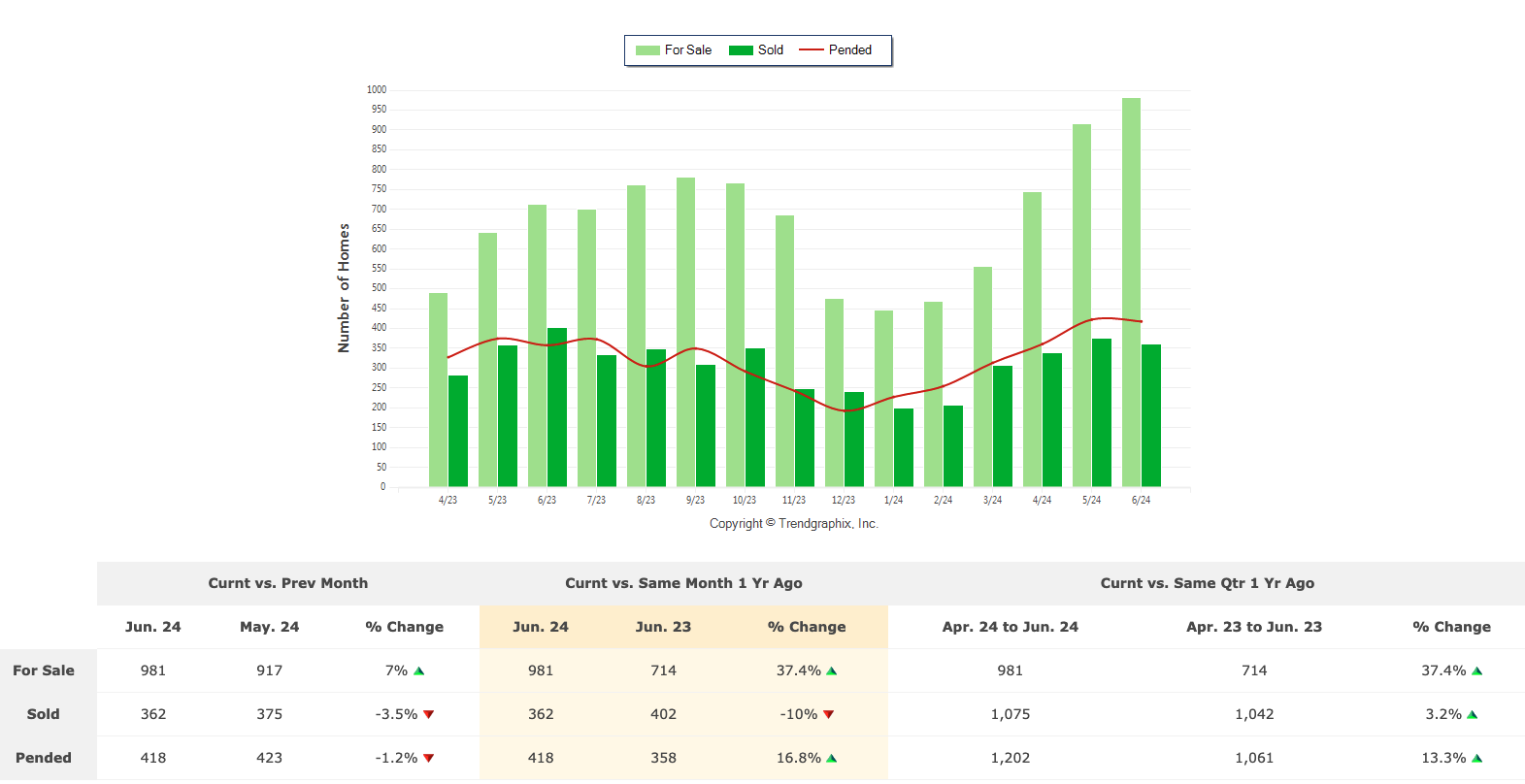

If you live in Sonoma County, you may have noticed that the number of homes for sales has increased sharply from this time last year. Up 37% to be precise! You may be thinking that this is a sign that inventory levels are up as more people put their homes on the market. Unfortunately this isn’t the case. The number of new active listings is actually pretty flat when compared to last year. What has changed are the inventory levels based on homes sold which has increased by 29% to 2.7months up from 1.8 in June last year. This basically means that if no new homes came on he market it would take 2.7 months for everything to sell out compared to 1.8 months this time last year. Also, just to give you an idea, as a rule of thumb, an inventory level of less than three indicates a strong seller market while an inventory level greater than six indicates a buyer's market. So we are still in a sellers market but it is definitely getting tougher for sellers.

The luxury market, which I am defining as homes worth over $2m, is a leading indicator for the housing market as a whole. So what is happening in this market? In this segment new listings are down 3% to just 149 across the county over the past 3 months. But what is more interesting is that homes are taking 20% longer to sell than this time last year and they are, on average, now selling for 93% of the asking compared to 98% of asking price

The good thing with the recent Federal reserve announcement is that it does feel like interest rates have stabilized and will likely only head in one direction which does make for a more stable and certain environment which is a positive thing for the housing market. There is a real possibility that mortgage rates might decrease slightly if inflation continues to decline and if the Fed implements the projected rate cut this will definitely drive up demand as more buyers step off the sidelines.

That all being said, there is another housing elephant in the room. The pending presidential election which tends to create uncertainty in the minds of buyers and sellers because Elections can lead to changes in fiscal policies, resulting in buyers and sellers adopting a wait-and-see approach until the policy direction becomes clearer.

Historical data also suggests that the housing market typically experiences increased volatility during election years which can be due to uncertainties about future economic policies and their impact on the broader economy

On top of that Elections can influence consumer confidence, again affecting buyer and seller behaviors. High consumer confidence can drive housing demand, while uncertainty or pessimism can lead to reduced market activity

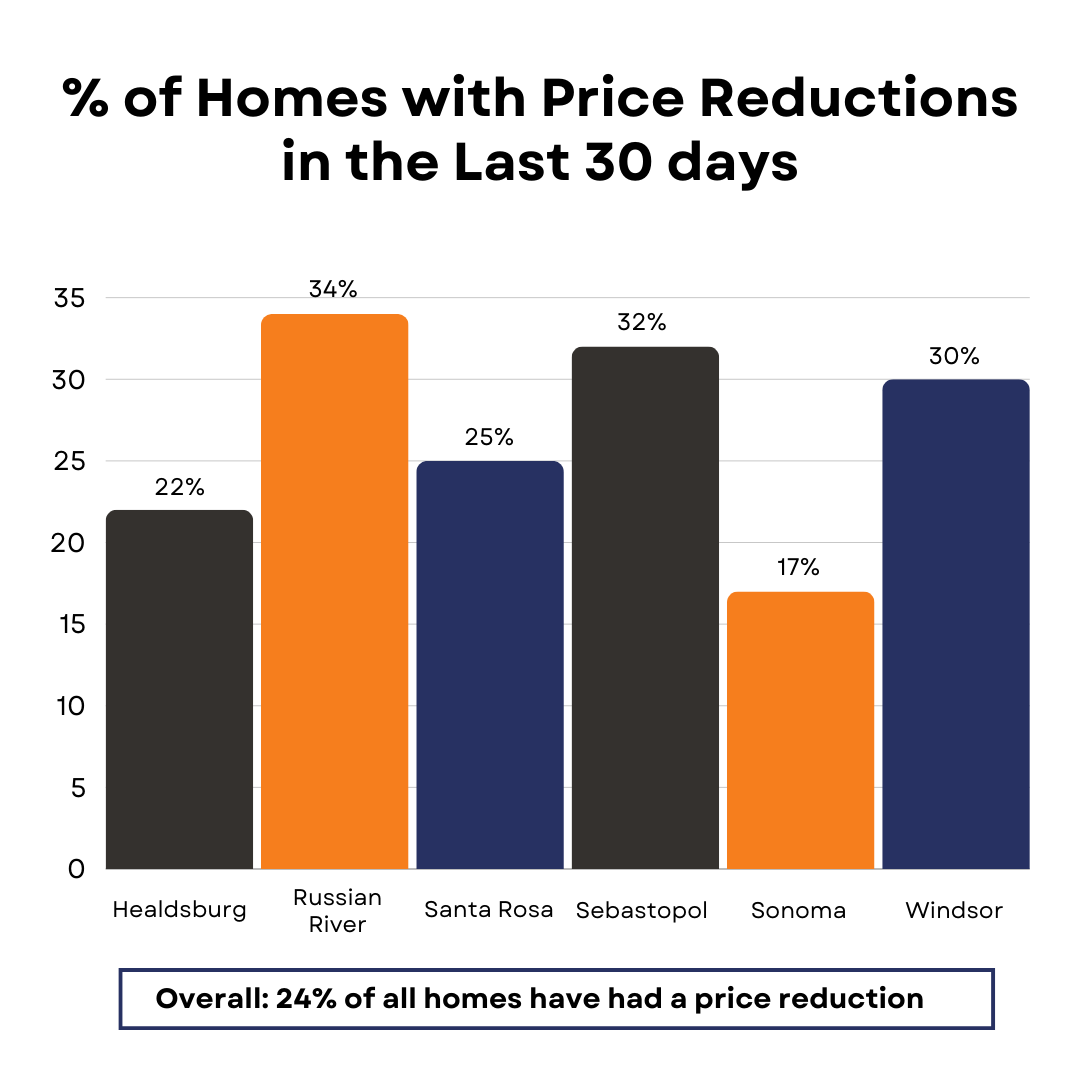

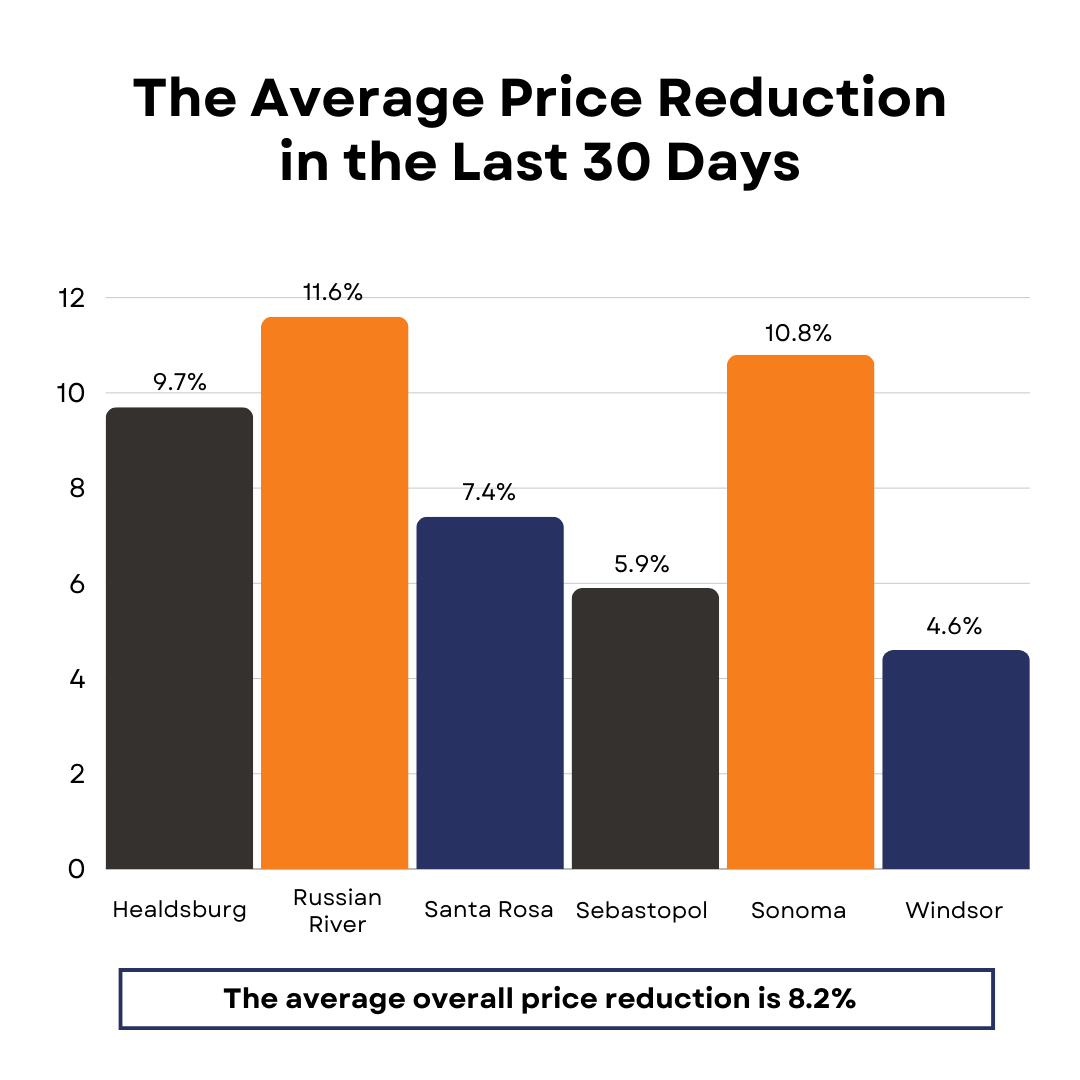

While the Fed’s actions should have given buyers some renewed confidence that rates will only get better, it’s clear that the market is not as strong a sellers market as some of the numbers indicate. One data point worth noting is that we are seeing an increase in the number of price reductions across the board with an average of 24% of all homes seeing a price reduction over the past 30 days. These price reductions have varied in size but on average have been 8% over the past month.

The area that has been hit hardest with price reductions is the Russian River with 34% of homes for sale seeing a price reduction over the past month.

While there is a correlation between higher end properties and larger price reductions big price reductions aren’t confined to multi-million dollar homes although its hard to ignore a property such as 5285 Westside Road, Healdsburg that had a whopping 36% price reduction from $13.9m to $8.9m

The popular markets of Sonoma and Healdsburg are showing the most resilience with just just 17% of homes in Sonoma having a price reduction and Healdsburg 22% compared to the average of 24% which is somewhat surprising given they also have more higher end homes. It just goes to show the power of location, location, location!

However there are plenty of homes at much lower prices such as 1320 Westside Ave, Forestville that has a 33.33% reduction from the original price of $450,000 to its current price of $300,000 so even lower price homes aren't immune from these price reductions, although in this case it was clearly priced Badly from the outset.

What is interesting about this data is that the Russian River market, typically one of the cheaper markets in the County, is also the area that is seeing the highest average price reductions which seems counter intuitive

For example, the average price reduction in the Russian River is 12% over the past month. This is even more than the average reduction in the high end markets of Healdsburg and Sonoma and more than double the reductions we are seeing in a similarly priced market such as North West Santa rosa

One reason for this, in my opinion, is the fact that this is the first full summer season of home sales impacted by the change in the vacation rental rules. This is resulting in a fall in home price values with the median home price falling by 5% compared to this time last year. This compares to markets like Sonoma and Healdsburg where prices continue to rise by 7% and 4% respectively.

The flip side of this, is that homes in the Russian River, that are vacation rentable are definitely more scarce and so are commanding premium prices. For example, I recently represented buyers for the only two properties that have sold for over $1.3m in the last 18 months. Both of these properties were vacation rentable and both were under offer within 10 days of coming on the market. So if you do own a home in the Russian River and it is vacation rentable, you are in luck if you are looking to sell it.

So what does all this mean?

The combined effect of continued high interest rates and the natural uncertainty caused by a presidential election, means that the market will be likely be slightly schizophrenic which is something we are seeing across the board.

For sellers, it mean three things. You have to get your pricing right. If you list too high to start with, I guarantee you will be leaving money on the table.

If you have a home that is turnkey, move-in ready you will be able to continue to get a premium price. In the last month we have sold three homes that were totally turnkey with buyers in contract after 10 days at or close to asking price. In this market it is more important than ever to get the pricing right because if you don't you will almost certainly leave money on the table

If you do want to sell, I would either move quickly to get it on the market now so you can take advantage of the typically strong buyer market in Aug or September or else you should get it ready over the winter to be ready to go on the market early next year to try to avoid the undoubted post-election flood of homes.

For buyers, you have a lot more leverage than you did a year ago. The challenge for buyers is that a lot of sellers think they are in the same market we were in a year ago and that just isn’t true.

If you are prepared to buy a home that isn’t totally turnkey, it is a good time to try to find some value in the market prior to the likely increased buyer activity next year.

There are also some opportunities created by sellers who are in an increasingly difficult financial position for those people who have bought homes expecting interest rates to fall and they just haven't or where circumstances have changed and so the monthly cost of carrying the property has just got too much. We are already starting to see some forced sales coming on the market with highly motivated sellers.

If you are a cash buyer, you will also have a lot more leverage right now because of the smaller number of buyers you will be competing with.

However if you are a buyer, looking for a home that has some scarcity value based on the fact it is newly remodeled or in a sought after location it will be hard to move the seller far off their price. In this situation you need to make sure you do everything you can to make an offer that optimizes all the other terms apart from just the price. You will be amazed at how many offers we see where buyers don’t put their best foot forward. Remember. there’s a lot more to an offer than just price.

So, that’s a summary of where we believe the market is right now. And if you’re looking at your options as a seller, you might be interested in our video all about “Selling Luxury Real estate”. It might give you some ideas if you are thinking of selling your home..

If you’d like to talk more about whether now is the right time for you to buy or sell your home, I’d love to help out! Just email me at david@bruingtonhargreaves, I’d be happy to chat with you and be a resource.