Sonoma County is less than an hour from San Francisco and yet it feels a million miles away with its breathtaking landscapes, world-class vineyards, and distinct communities, so it is no surprise that it is a popular destination for people from the Bay Area to buy a second home. We only need to look at the data to see how popular different towns are for investors to purchase a secondary property whether it is a dedicated second home, a second home that they also rent out, or a fully fledged investment property.

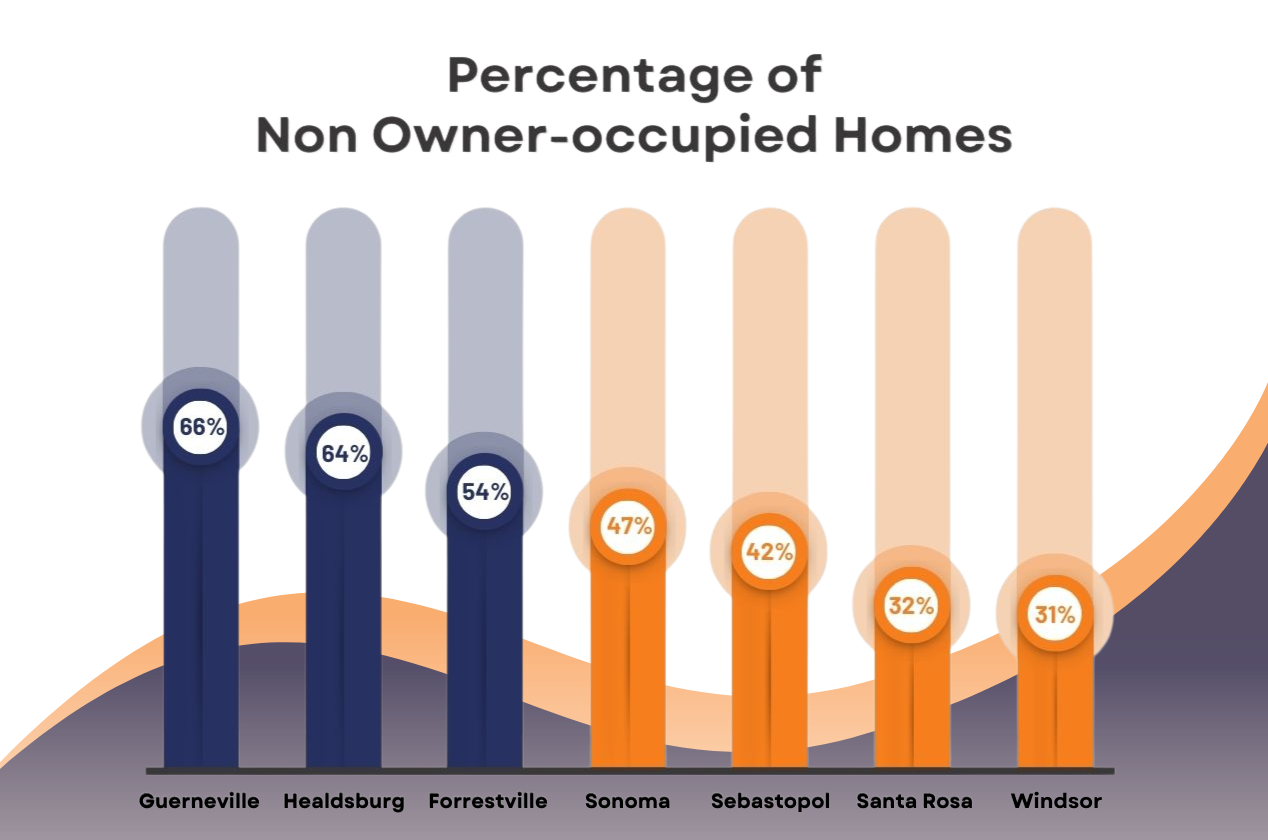

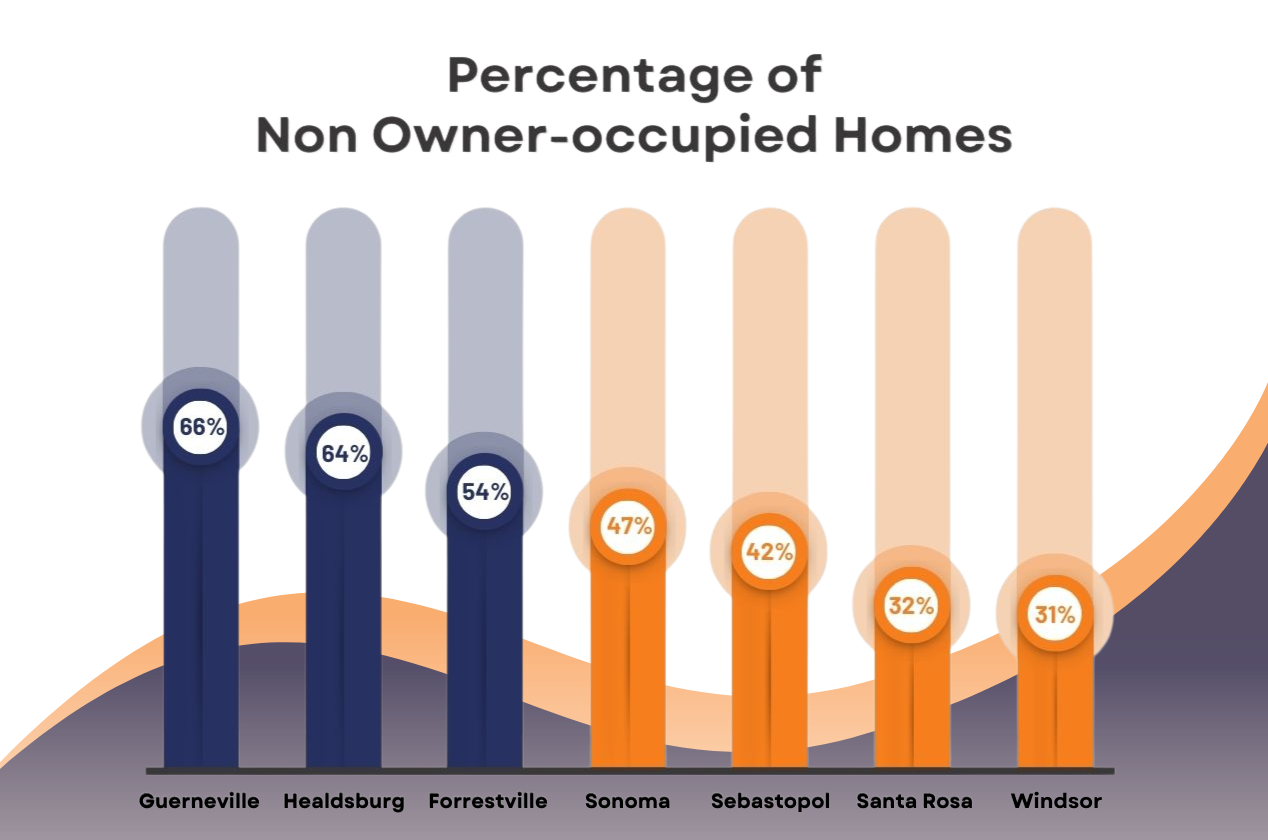

As you can see from the chart below, if we look at all the transactions completed in the first seven months of this year, 66% of all purchases in Guerneville were for non-owner occupied properties while in Healdsburg the number wasn't much lower at 64%. I should make it clear that this data, taken from tax records, indicates that these homes are being purchased as a non-primary residence, or rather that the owner does not occupy the home. This could mean that they were purchased as a second home, a vacation rental, or as a long-term rental investment property.

What is interesting when we look at the data for Guerneville, for example, is that you would automatically assume that the properties are being purchased as vacation rentals because the Russian River is such a popular area for vacation rentals however this data represents the first seven months of this year when there was a moratorium on vacation rentals for the first five months and then when the new ordinance came into place which actually makes it a lot harder to find a vacation rental in Guerneville which means the vast majority of these homes are either dedicated second homes or long term rental properties. My guess is that they are second homes because Guerneville is not the most obvious place for an investor to purchase a long-term rental property.

If we look at a market such as Healdsburg, in the first half of this year, 64 percent of all purchases were non-owner occupied. Again, Healdsburg as an area has relatively limited options when it comes to finding a vacation rentable property so while there are definitely some of the purchases were for vacation rentals (I know in my team we represented 4 buyers in the first half of the year), many of these will have been for dedicated second homes, longer-term rentals or even mid-term rentals which is becoming more popular because vacation rentals are banned from within the city limits but you can rent a home for 30+ days and then still have the opportunity to use it for personal use when it isn't rented out. The other factor impacting a market like Healdsburg is that it is seen as a market which is good for a longer-term investment because of the popularity of Healdsburg and the increasing cache the city holds with it being established as the food capital of Sonoma County.

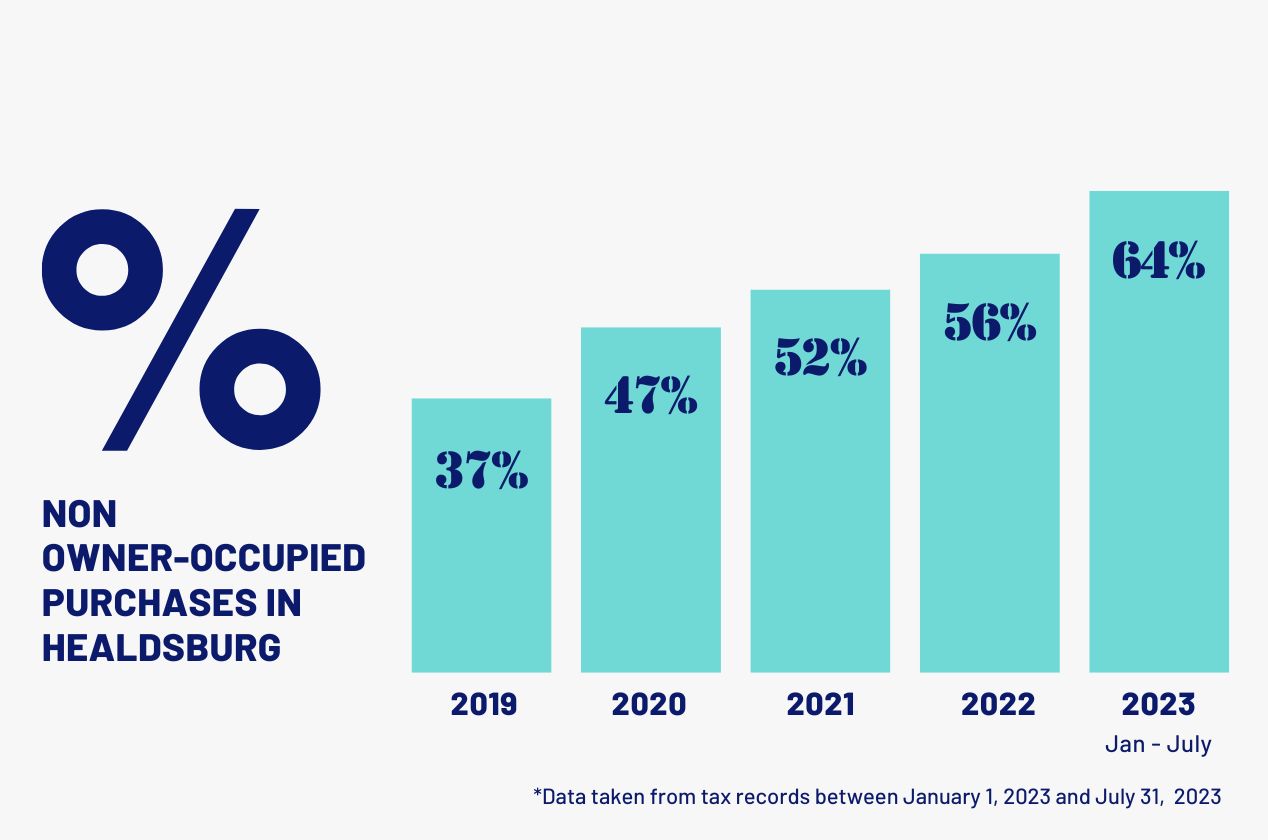

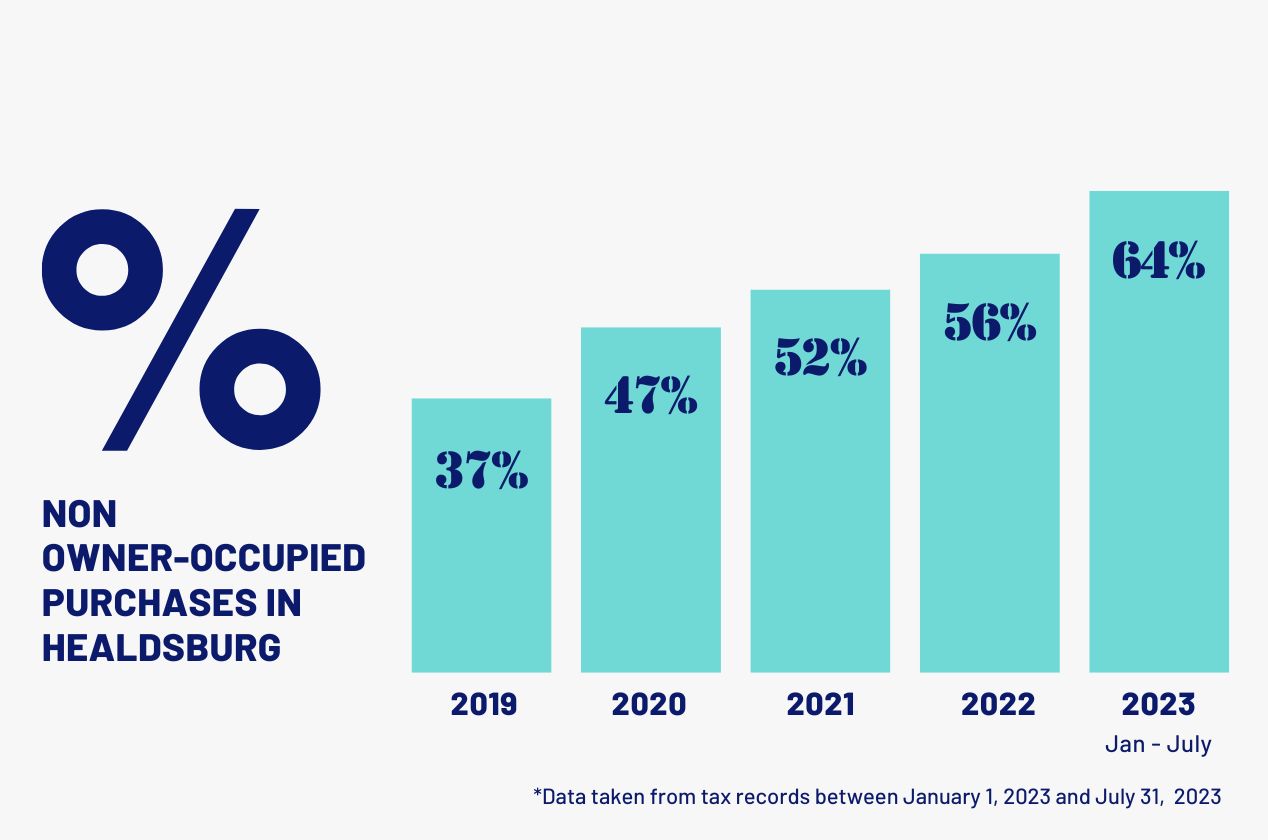

If we look at the data for Healdsburg for the last five years we can see there has been a steady increase in the number of homes that have been purchased as non-owner occupied homes. It is hard to know exactly what this can be put down to but I can only assume it is the increasing popularity and status of Healdsburg as "a hot town in California" but I also feel that the pandemic has also contributed to the increasing number of people who have purchased secondary homes in Healdsburg. Let me explain. Before the pandemic if you worked in the Bay Area you had to go to the office 5 days a week so if you were to buy a second home you would only really use it at the weekend. However, during the pandemic, there were a huge number of people who lived in San Francisco or the larger Bay Area who purchased homes up here because they could work from their secondary homes. In fact, they likely spent more time in their second home than they did in their primary home.

Even now that the pandemic has ended and a lot of companies are asking their employees to go back into the office, most people don't need to go in more than a day or two a week which is still very doable if you are spending significant time in Healdsburg. In short, because of the change in work practices, if someone is thinking about a second home, it is now probably more viable than ever because it is possible to spend more time using it. What will be interesting is to see if over time this number actually starts to decrease as more and more people decide they can make their Healdsburg home their primary residence and uproot themselves from San Francisco. I certainly know a number of people who have done exactly that.

What Are The Options If You Need To Get Some Income From a Second Home?

While a large number of these non-owner occupied homes are definitely dedicated second homes, there are a lot of people who need to get some income from a secondary home. There are a couple of options, long-term rental investment properties, short-term rentals, or something in between.

Short Term Rentals

Over the past decade, there has been a huge boom in the vacation rental business. You only need to look at Airbnb as a business and see that for the twelve months ending March 31, 2023, their revenue was up another 32% to $8.7B so if Airbnb is a barometer of the health of the market it tells you the market is still going strong. If you are interested in learning more about the health of the vacation rental business in Sonoma County check out my recent video in the description below.

Although there are a number of pros and cons to vacation rentals, as with any real estate purchase there are bad purchases and good purchases. You need to think about who the audience is for the rental and make sure that you buy in an area that will meet your goals. Some properties with never make a good vacation rental.

Pros of Vacation Rentals:

Flexibility:

I would guess that at least half of the homes being purchased as non-owner occupied are either being purchased as dedicated second homes or as properties that can be operated as vacation rentals but which the owners also want to enjoy. In a place like Sonoma County which is so popular as a weekend getaway place from the Bay Area, the ability for a homeowner to short-term rent their place is an attractive option because it means that they can also get to enjoy it.

I work with numerous clients who really want a second home that they can enjoy but they need to get some income on it to make it a viable financial investment. For many people, their goal is for it to be cost-neutral. They don’t need to make a profit, it is more important to them to have a place that they can enjoy and get the benefit of potential capital upside.

Higher Rental Income:

Short-term rentals, through platforms like Airbnb and VRBO, will always command higher nightly rates compared to long-term leases. The big question is how often they get rented out, in other words, if you can get $1000 a night, it is important to understand how many nights you can get it rented per year.

If we take a market such as Healdsburg for example, you can expect an occupancy rate of 63% with an average daily rate of $850 for a 3 bed home. This quickly adds up to getting an average of $12,000 per month in income for a 3 bed home. It’s definitely a popular option as there are currently 239 active vacation rentals in Healdsburg.

If we look at a market such as Guerneville, you can expect similar occupancy levels but with an average monthly amount of $6500 for a 3 bed place. The big difference of course is the purchase prices in Guerneville are likely to be a third of the equivalent place in Healdsburg.

Market Adaptability:

The other good thing with Short-term rental properties is that you can quickly adjust pricing to take advantage of favorable, or less favorable market conditions, potentially maximizing their profits. This was no more evident than during the pandemic when nightly rates went through the roof as people maxed out their income. Of course, the converse is true. Many vacation rental owners right now are having to reduce their rates to maintain their bookings. While this isn’t ideal, at least you do have the flexibility which you don’t have if you are locked into a 12-month lease and conditions change.

Tax Benefits:

I am not a tax expert and you should definitely get separate tax advice but I have numerous clients who use a technique of tax aggregation to offset some of their costs for running their vacation rental business. The important thing is that you are actively involved in running the business so you can’t outsource the management of it to get these benefits. In essence, you elect to aggregate your “business” for the purposes of qualified business income resulting in a lower tax bill.

So What Are The Downsides of Vacation Rentals?

Higher Operational Demands:

Managing short-term rentals can be labor-intensive, involving frequent guest turnovers, cleaning, maintenance, and guest communication. A lot of people refer to Airbnb as passive income. But that is just plain wrong!

A successful vacation rental needs to be operated like a business. It needs to be managed by someone who cares about creating a great guest experience. This is more important than ever, especially in a tougher economic environment. It is the vacation rentals that go out of their way to create a unique experience that are the ones that will truly deliver the returns.

If you do choose to outsource the management of it then there are plenty of options but you will pay a hefty management fee in the order of 20% of the monthly income.

Seasonal Variability:

Unlike a long-term rental when your income is predictable, with a vacation rental you will have big seasonal fluctuations so you need to be able to ride out the quieter winter months and take advantage of the busy summer months. For some owners, this creates a dilemma when they are looking to use the property for themselves because they have to weigh up lost income on a holiday weekend vs. get the enjoyment of the home for themselves on a popular weekend.

Regulations:

Certainly in Sonoma County the biggest challenge for someone wanting to own a vacation rental is finding an eligible property. For example, you may want to own a place in Sonoma City to enjoy for yourself and then rent it out when you are not using it but unfortunately, most cities in the county do not allow for vacation rentals.

As a result, you need to identify properties on the outskirts that would be eligible for a permit. There are lots of opportunities for finding places but you need to navigate some of the complexities around zoning, exclusion zones, and septic systems. I have a website where I list all the properties in the county that are for sale and are eligible so if you want to get access to that send me an email or give me a call.

The good thing about the restriction on the number of properties is that if you do purchase one there is a natural limit on the number of competing vacation rentals in a given area so it does help the overall profitability of the ones that do exist.

I made a video about the best places in the county to find a successful vacation rental so if you are interested check it out below

Benefits Of Long-Term Rentals?

As with short-term rentals you need to identify properties that will make a good long-term rental and which will give you the returns you are looking for whether it is a multi-family property or single-family home or family home with ADU.

With the current interest rates it is increasingly hard to make the numbers work in Sonoma County but as a general rule if you can find a property where the monthly rental income is at least 0.5% of the purchase price you stand a chance of the numbers working. In other words, for a million-dollar property, you want to be getting $5k per month in rent

One of the reasons properties with ADUs have become so popular is because if you have a single-family home and then can generate an extra $2k to $3k per month from an ADU it makes it easier for the numbers to work.

Stable Income:

The biggest thing about long-term rentals is that they offer a consistent and predictable monthly income, making financial planning more straightforward. Tenants typically sign up for a 12-month lease and then will run month to month thereafter so you know exactly what your income is going to be and to a large extent, apart from unexpected repairs, you know what you will net at the end of the year.

Lower Vacancy Rates:

Unlike a short-term rental where occupancy rates are 60-75%, a longer-term rental should have minimal downtown. If you are lucky you will get a tenant who stays beyond 12 months and so you can end up with literally no downtown over a 2 or 3-year period. Of course, it only takes not getting rent for a couple of months between tenants to make a big dent in the finances for the year as you lose a sixth of your income.

Less Hands-On Management:

Property management for long-term rentals often requires less day-to-day involvement, allowing investors to be more passive. In my experience, you will often get a lot of calls in the first 45 days whenever a new tenant arrives but then hopefully after the initial teething period, you won’t hear from the tenant for months on end until the washing machine breaks. Because the management is less hands-on, a property management company will also charge a lot less, typically 6-10% of the income.

Lower Operational Costs:

Compared to a well-run vacation rental, a long-term rental will generally net less profit. However, for some people, the reliability and reduced risk of a long-term rental is the way to go. A big part of the economics of a long-term rental is choosing the right property in the first place. Because of the predictability of income, it is pretty easy to work out if a property makes sense as a long-term rental property.

What are the Downsides of Long-Term Rentals?

Lower Rental Income:

Long-term rentals don’t have the headline figures of a vacation rental so compared to a high-performing vacation rental you will always make less money but then the risks are higher. The question is whether you want a safer investment without the variability or go for a higher risk higher rewards approach of a vacation rental.

Reduced Flexibility:

It goes without saying that Long-term rentals restrict your ability to use or sell the property as you wish due to lease agreements. If you want the ability to use the home yourself, then this rules out long-term rentals. Even if the property is vacant for a month or two, it will likely be unfurnished so it’s not like you could use it when it isn’t occupied.

Rent Control:

One of the challenges for landlords is the limitations they have when it comes to increasing rates. IF you have a tenant in a property and they stay there for 5 years the chances are that they will be paying well below the market rate. Of course, there is a balance between a stable tenant and getting the highest market rent but this is always a juggling act for long-term landlords.

Tenant Issues:

As anyone who is or has been a landlord, most of the time things work out just fine however there are times when a tenant refuses to move. I have had this experience myself and had to use the full force of the law to evict a tenant when I wanted to sell a property. It is always possible to get rid of a tenant, it is just a process you have to go through.

Unlike a vacation rental where Airbnb takes care of all the payment so it is impossible to have someone not pay for a stay, with long-term tenants you don’t have the same control over getting the money. There will be times when a tenant doesn’t pay for whatever reason and so this is just something else you need to navigate as a landlord.

What About Mid-Term Rentals? The Best of Both Worlds For Non-Owner Occupied Homes

Both short-term and long-term rentals have their pros and cons but there is a third option which I call a Mid Term rental. So what is a mid-term rental?

It is a rental for 30 days to 90 days. In some ways, it is similar to a short-term rental because the property needs to be furnished and fully equipped, and in fact platforms like Airbnb have a whole section for 30+ day rentals. For some people, it is the perfect solution because it evens out some of the income bumps and troughs although the monthly income will be less than vacation rental income it will be more than a standard 12-month lease.

Over the past few years, I have seen more and more homes being rented on this basis, particularly in places like Santa Rosa which are close to some big hospitals because there is always a steady flow of traveling nurses and doctors who need accommodation for 30 to 90 days for an interim position. There is even a website called Furnished Finders which specifically caters to this market.

Even in places like Healdsburg, there is a strong market for furnished rentals for 30+ days. The typical guest is someone who wants to spend a month or two in Healdsburg as an extended break from their primary residence. For example, a client of mine lives in Colorado but comes to Healdsburg every year for a month in October to enjoy the weather and harvest.

Similarly, there is always a market for people who are looking to purchase in Healdsburg but haven’t found the right place yet so want to rent something for 3 months while they find something, or for people who are doing a remodel and so need to vacate their house for a few months while the work is completed.

The great thing about this type of rental is that it enables you to purchase a home in a city which would not allow for vacation rentals, but at the same time, it gives you some income and allows you to use the property yourself.

Will We See More and More Second Home Purchases?

When I first looked at the data I must confess I was surprised at how many purchases were non-owner occupied in some of the key cities in the county. I probably expected it in a place like Healdsburg or Guerneville but even in a place like Santa Rosa, nearly a third of properties are purchased as non-owner occupied presumably because it is such a strong long-term investment market. Because of many of the factors I have touched on such as the demise of San Francisco, more affordable home prices compared to the Bay area, and people's increased work flexibility, not to mention the outstanding beauty of Sonoma County, I can only see Sonoma county continuing its upward rise as a place for both second home owners, vacation rental owners and long term real estate investors. Which one is right for you depends on your goals for the property and whether you want a pure investment property that you never use or if you want to enjoy the property yourself. It also depends on your tolerance for risk and whether you want to chase the maximum returns you can get on a vacation rental. Most people will only ever think of short-term or long-term rentals, but for some people, the mid-term rental market gives you the best bits of both without some of the headaches associated with either.