Today interest rates are over 7% for a 30-year mortgage, even higher than one year ago, and yet homes in Healdsburg city limits are selling 20% faster than they were a year ago with a third of all homes getting multiple offers.

In any normal housing market when interest rates are so high, you would expect the market to be strongly in favor of buyers with properties struggling to sell but that is not the case. For example, 104 Marion Lane, 1016 Sunnyside Drive, and 213 Chiquita Road, all sold this year and all got 5 offers! Inventory levels, still hovering around 3 months, also point to a seller's market.

213 Chiquita Rd, Healdsburg

So what is happening in the Healdsburg market? Have prices softened? If you are looking to sell is now the right time? If you are looking to buy, should you wait to see what happens?

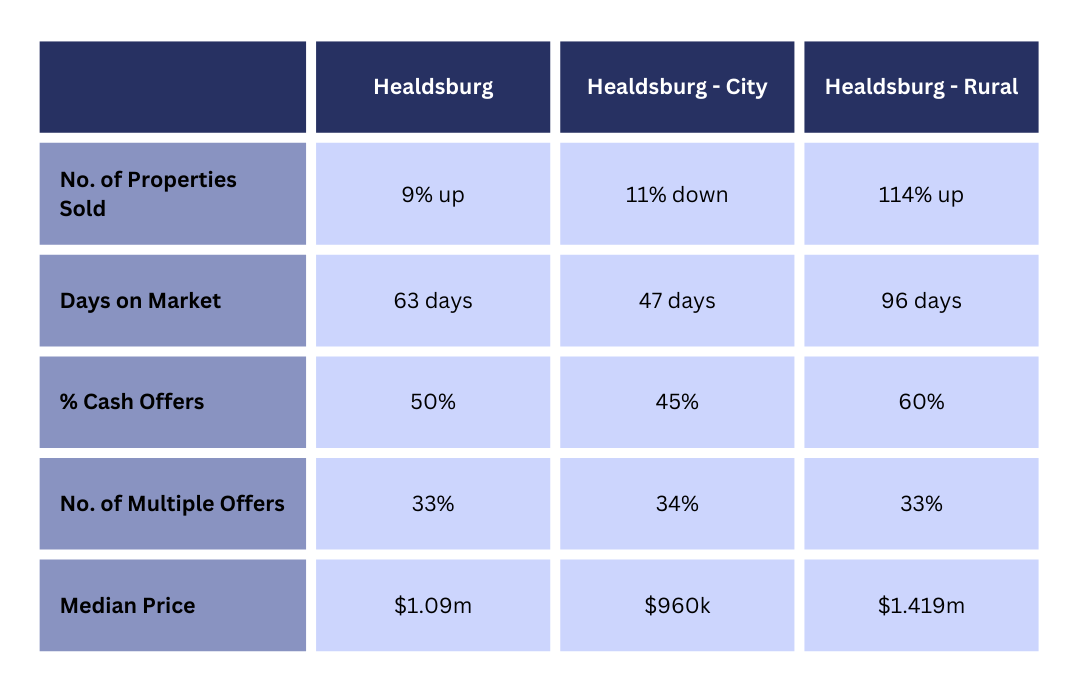

I recently took a look at the housing market data for the Healdsburg area from Jan to April 2024 and compared it to the same time last year. I also analyzed the data for properties within the city limits versus more rural properties to see if there was a difference. So what does the picture look like?

There is no question that for anyone looking to finance the purchase of a property right now, it is tough, with a $1m loan likely to cost around $6000 per month. Despite the high costs of home ownership, the number of sales still increased nearly 10% year on year from Jan to April. It is probably no great surprise that the number of cash purchases also increased dramatically from 28% last year to 50% of all transactions so far this year. This balance is even more pronounced for more expensive rural properties where 60% were purchased for cash.

So what are the big factors that are influencing the Healdsburg housing market? There are three main factors: the relative affordability of homes, the limited supply, and the increasing popularity of Healdsburg as a purchase destination, especially for an older demographic.

Let’s first tackle the thorny question of affordability. In any housing market, affordability is driven by three things: interest rates, median prices, and median incomes. By any normal measure, Healdsburg is in no way affordable for someone who lives and works in Sonoma County where median incomes are 35% lower than in the Bay Area. However, a significant percentage of homes are purchased by people who are earning Bay Area salaries and who are used to Bay Area or San Francisco median home prices which are still 20% lower than Healdsburg prices. This difference in incomes and house prices resulted in 64% of all homes purchased last year in the Healdsburg area being purchased as non-owner occupied homes which indicates they were either investment purchases or purchased as second homes. So far this year, that number is much lower at 36%.

104 Marion Ln, Healdsburg

One of the great things about the city of Healdsburg is the limits put on the growth of the city. In recent years much of the allocation has been taken up by the developments at Montage and Mill District. While these limits on the number of new homes being built are great for controlling growth, it does create a limited supply in a market where there are already fewer people willing to sell than buy. If we look at the number of homes for sale this year it is half the number of homes that were for sale five years ago in the year ending March 2019. The limited supply is enough to drive an upward market in its own right.

Whether we like it or not, Healdsburg is getting to be more popular, not less popular, driven by its status as a food and wine destination and the lifestyle it affords. It’s an amazing place to live whether you are 30 years old or 60 years old. Its attraction as a destination among people who are either work-optional or retired further drives a housing market where cash is king. It has been well documented, that we are in the middle of one of the biggest ever transfers of wealth from baby boomers, aged 60 to 80 years old, who hold $70 trillion in assets, half of the nation’s wealth. There is no question that some of this wealth is being used to purchase homes in Healdsburg.

With lots of buyers competing for limited supply, you might think that prices are continuing to rise but certainly in the first part of the year that is not the case. Median prices have fallen back nearly 8% since this time last year, with the average home in city limits selling for $774 per sq ft. This is counter the trend in Sonoma County where prices have continued to rise. (However, I would urge some caution here as the volume of homes sold is not necessarily statistically significant so there is a potential for a large margin of error in the median price data.)

That being said, I know from my own experience that a lot of sellers of premium downtown properties are keeping an eye on the prices that homes in Mill District and Montage are selling for as an indicator of the value of their homes hoping there is a positive impact on the value of their home. When we look at the value that properties are trading at we almost need to discount for the “Luxury Development Effect” because if we remove these sales the average price per sq ft for homes in the city actually falls 10% to $689 per sq ft. Inevitably there is some halo effect but places like Mill District and Montage are very different propositions targeting very different buyers.

746 Dragonfly Ln, Healdsburg

When looking at housing market trends, we also need to make a distinction between rural properties and properties in the city limits because they represent very different buyers. Ever since Covid, there has been a strong demand for rural properties and this year is no different with sales of rural homes doubling compared to this time last year. That being said, if you are looking to sell a rural property, as long as it is appropriately priced, you can expect it to take three months which is double the amount of time it takes to sell a property in the city limits.

What About The Future?

If you are thinking about buying or selling a property, is now a good time?

I think we all thought that interest rates would be significantly lower at the end of this year than they were at the start but that is not going to happen because of the stubborn inflation numbers and strong employment data. Current estimates expect rates to stay the same or maybe fall to the low 6 percent level but that isn’t enough to change the dynamics of the market. However, we do have the small matter of an election coming up which can do two things. It increases market uncertainty leading to cautiousness among investors and consumers. Second, elections can impact consumer confidence, which in turn affects the housing market. Positive election outcomes or perceptions of stability and economic growth can boost consumer confidence, leading to increased homebuying activity but the reverse is also true!

2319 Mill Creek Ln, Healdsburg

If I were thinking about selling, and I wanted to do so within the next 12 months, I would want to do so now before we get into the election season while lack of inventory is on my side you must make sure the home is dialed in and priced right. For buyers, the picture is a little less clear. If I was looking to buy a downtown property or a rural property that is popular among Bay Area buyers I would absolutely want to buy now, as I just can’t see prices coming down for premium properties.

If you are looking for something that is less popular, you can bide your time and wait for a property to come up that meets the majority of your criteria. However, you will want to make sure that you find something before interest rates start to fall because that will only bring more buyers to the table competing for low inventory levels that I don’t expect to increase anytime soon. You can rest assured that if you sit on the sidelines, you almost certainly end up paying more in the long run. Let’s face it, no one ever looks back and thinks - I wished I had waited before buying my place in Healdsburg.

Note: All data is based on Feb 23 - April 23 vs Feb 24 - April 24 From MLS