Not a day goes by without me being asked about insurance in Sonoma County. Is it possible to insure a home? How much does it cost? Is it getting worse? It’s a complex subject and one that is made even more difficult by virtue of the fact that insurance companies are very secretive about their criteria for both the insurability of a home and the cost of that insurance. That being said, the underlying truth is that California’s home insurance market is in turmoil almost entirely due to the increasing frequency and intensity of wildfires which is largely attributed to climate change. In this post I will cover the background to the crisis, the specific actions which have led to the current problems, the things that home buyers or homeowners can do to help get insurance, and importantly, what are some of the proposed solutions and the outlook to get insurance in the future.

Why Is There a Crisis in California Due to Wildfires?

Even as I write this blog post, the Park Fire, near Chico, has now become the fourth-largest wildfire in California's history, scorching 399,437 acres. This massive fire has destroyed hundreds of structures and is impacting diverse vegetation and ecosystems.

We see a repeating pattern whereby this year’s wildfire season is significantly worse than previous years with wildfire activity up 2,816% compared to the same period last year equating to over 750,000 acres being burned which is nearly 30 times more than last year.

While fires are a lot worse because of the increased temperature, unfortunately most causes of fires are man made either deliberately, as is the case with the Park Fire, or accidentally by a discarded campfire or machinery and sometimes by natural causes such as the Comlex Fire in 2020 that was ignited by the Complex Fire.

This dramatic increase in wildfire activity in California has drastically impacted the home insurance market. Just to put it in perspective, the top 20 most destructive wildfires in California’s history have mostly occurred in the last decade with climate change being the biggest factor, increasing the frequency and severity of wildfires and affecting the overall risk landscape.

I will often talk to people from the Bay Area who live in Marin or the East Bay and they automatically assume that Sonoma County has bigger problems when it comes to insurance. But that just isn’t true. For example, I used to have a home in Mill Valley which I sold last year, and at the same time, I had a home on Chalk Hill Road in Healdsburg which was impacted by fires in 2017 and 2018. My insurer dropped my Mill Valley house but was happy to continue to insure my Healdsburg home!

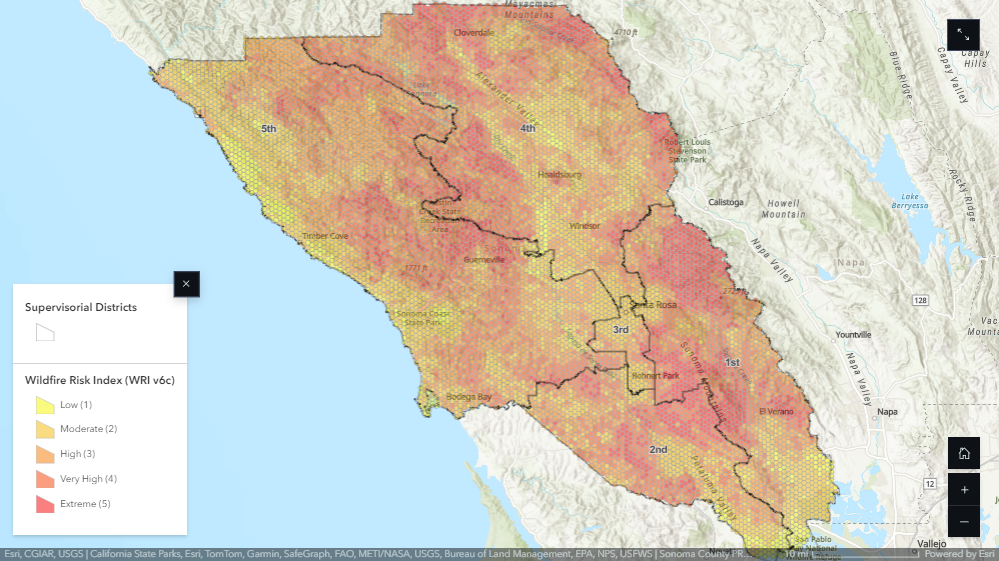

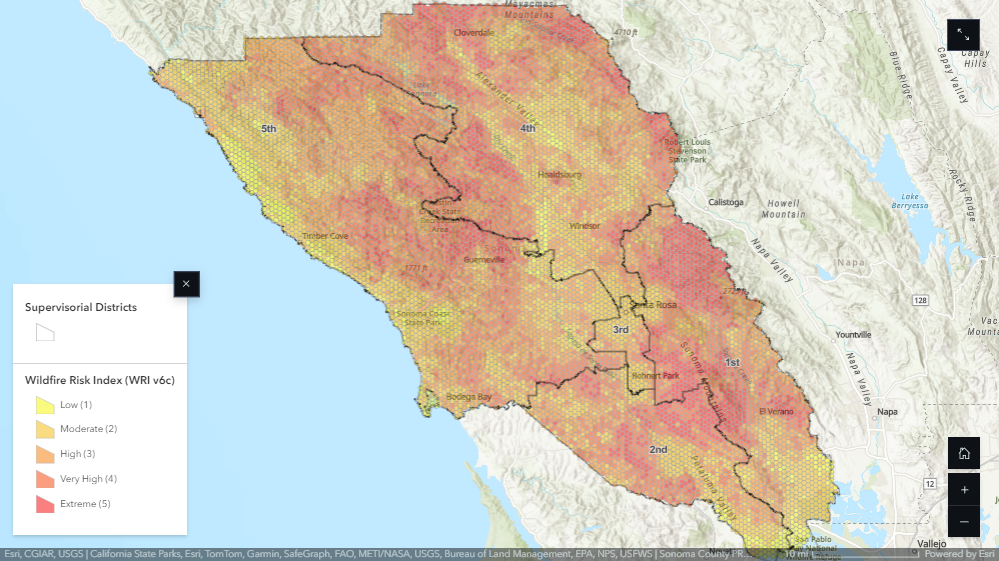

If you look at the fire risk map then Contra Costa County, Alameda and Santa Clara are all “very high” fire risk compared to Sonoma County and Marin which are “relatively high”. Don’t get me wrong, it’s not great, but Sonoma County is in a similar position to many counties up and down the West Coast from San Diego to Canada. It is a wide-scale problem.

What Are The Problems with the Current System?

First of all insurance companies are not required to provide insurance to everyone, unlike utility companies. So to make sure that everyone can insure their home, the California FAIR Plan (FAIR Access to Insurance Requirements) was introduced. The California FAIR Plan is an insurance program of last resort designed for homeowners who cannot secure coverage through the standard market. It is funded by private insurers operating in California and offers coverage for fire, lightning, internal explosions, and smoke.

The big problem for insurers is that if there is a major fire event and the FAIR Plan funds to pay out are depleted, then FAIR Plan can then assess insurance companies operating in the market to bridge the financial gap. As things currently stand these companies have no direct way to recoup those costs.

The net result is that the biggest insurer, State Farm, pulled out of the market in May 2023. Because it has the biggest share of the market, if there was a major bailout of FAIR Plan needed then State Farm, as the biggest company operating in the California market, would have to pay the biggest share. Their answer to the problem was for them to pull out so they wouldn’t have so much liability.

But they weren’t the only ones. Allstate pulled out in November 2023. In fact, Seven of California’s 12 largest property insurers have limited their coverage. In addition to State Farm and All State, Farmers is only writing 7000 policies per month, USAA is only writing home insurance policies in lower-risk wildfire areas, Travelers is writing fewer new home insurance policies and Nationwide scaled back the volume of new policies

With more and more companies pulling out, that means that more and more homeowners had to resort to using the FAIR Plan . So it’s no great surprise that the number of FAIR Plan policy holders has more than doubled since 2018. With 1000 people per day seeking coverage, the FAIR Plan now insures $320 billion dollars worth of property which is six times what it insured in 2018. This increase places a significant financial strain on the FAIR Plan, as it must cover a growing number of high-risk properties. Just to put this into context, if there was a wildfire as damaging as the Camp Fire which destroyed 18,000 buildings then the program would likely face $6 billion in claims and yet it has limited reserves and only $2.5 billion in re-insurance so the assessments that it would have to impose on the companies operating in California could be $3.3m. When you look at it like this, there is no wonder insurance companies are pulling out. They don’t want to be the ones left to have to close the financial gap. As more companies leave the problem just gets worse.

So What Can Homeowners and Homebuyers Do In The Current Market?

The good news is that there are still a number of reputable insurance companies still operating in California such as AAA, Liberty Mutual, Mercury, American Family, Kin, and Encompass still offer policies, though, as with all insurance there are certain restrictions

If you are not able to get insurance from one of these providers then FAIR Plan is the best option. However it is worth noting that the FAIR Plan is not as comprehensive as traditional policies so to plug the gaps, homeowners will need to purchase an additional DIC policy, or difference in conditions policy to provide coverage for items not included in the FAIR Plan, such as theft and water damage. Because of the way the FAIR Plan policy is designed, it is really important to work with an agent who has a lot of experience with FAIR Plan to make sure you get the coverage you need as well as make sure you put in place the necessary supplementary policy from a company like Aegis.

What Types of Homes Are Insurable?

I often get asked how do you know if a home is insurable? The short answer is you don’t. In fact there are two really frustrating things about the whole insurance process. Firstly, every insurance company’s underwriter has different rules so you can never second guess a property’s insurability and secondly, even the agents representing a single company, such as Farmers for example, can’t explain why two apparently identical homes are treated differently enabling one to be accepted and the other not.

However, that being said, there are some broad rules of thumb that I can share which are just based on my experience of making hundreds of phone calls trying to get insurance for properties. If a property is in a city limits it will generally stand a better chance of being insurable with a regular policy without the need for FAIR Plan . Part of the reason is that there are likely more resources nearby to protect the home such as a fire hydrant in the street adjacent to the home or else a Fire Department just down the road.

If we take two rural homes, one on a single-track lane up the top of a ridge, and one on the valley floor surrounded by vines, then the one down on the valley floor is much more likely to be accepted.

If we look at where many of the big fires in Sonoma County have taken place, a lot of them are to the East of the 101 where you generally get hotter conditions compared to being further out towards the coast. So if there are two homes, in very similar settings when it comes to proximity to amenities and the topography of the land, it is more likely a home out in Occidental would be insurable ahead of a home halfway between Napa and Sonoma Counties.

As I said, these are just guidelines, and a lot of it is common sense, not hard and fast rules.

How Much Does a Policy Cost?

This is where it really does get hard to predict because I have seen policy costs that have surprised me on both ends of the scale: very cheap and insanely expensive. All I can do is give you a couple of examples.

I had a client that purchased 14500 Solaridge Road in Guerneville. If I had to rank this home on a scale of 1 -10 on how expensive it would be to insure, I would put it very close to 10. It was up a single-track road, through trees, and sat on top of a ridge looking out over forest as far as the eye could see. It was spectacular. The home was a little dated but super cool. It wasn’t eligible for regular insurance but the annual FAIR Plan premium was estimated to be $4577 to cover fire, wind, and vandalism and then it could require a companion policy of $1200 per year to cover all the other risks such as liability, water and theft. So a total of $5777 per year for a 3 bedroom 2400 sq ft home.

If I take another example of my home, for example. It is set among vineyards on two sides and a creek and trees on the other and this was insurable with a regular insurer, Farmers, when I got it insured for the first time in October. This house was three times the price of the Solaridge property and yet my policy is just $6500. It is worth noting however that I did get a letter from Farmers as I came up to my renewal to say that they would drop me if I didn’t replace the washer hoses with stainless steel hoses. That was an easy fix. $15 from ACE Hardware and I could keep my insurance!!

Getting Dropped

One of the biggest challenges facing homeowners is getting a letter out of the blue to say that your insurer is dropping you. If you do get that letter it is important to know two things: by law, they must give you 75 days' notice to be non-renewed, and secondly, they must give you a detailed explanation and if they give you that explanation and you can remedy the problem then you can challenge the decision. For a bit of context, according to data from the California Department of Insurance, in 2021, 13% of policyholders were dropped by their insurer. I can only imagine that number has increased since then.

Home Hardening Your Home

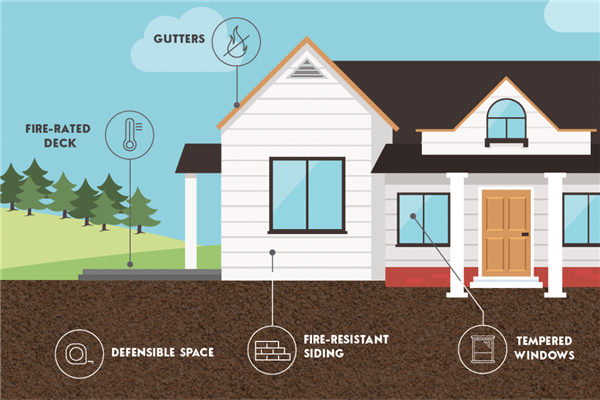

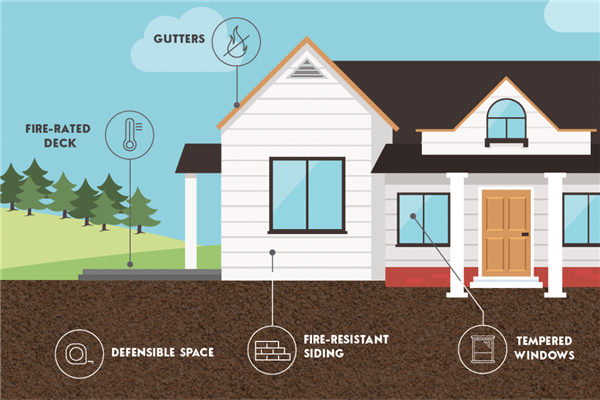

Every homeowner now has a responsibility to harden their home to some extent. To not do so is both negligent and it also puts neighbors at risk. CalFire recommends a number of comprehensive home hardening and defensible space measures to mitigate wildfire risks. Key home hardening steps include using Class-A fire-rated roofing materials, creating a 5-foot ember-resistant zone around the home, installing ember-resistant vents, ensuring 6 inches of non-combustible material at the bottom of exterior walls, and enclosing eaves. In addition, it recommends a number of measures to create a defensible space around your home both 0 to 30 ft from your home, and then less aggressive measures from 30 ft to 100ft which involves clearing dead vegetation, trimming trees, and maintaining vegetation-free zones around structures.

While taking the steps to harden your home as an individual is something everyone should undertake, there are also a number of organized schemes that involve the community coming together to be proactive about protecting against wildfire. One of these programs is the FireWise program which is a national initiative led by the National Fire Protection Association (NFPA) that helps communities prepare for wildfires. The program encourages collaboration between residents, local fire departments, and other stakeholders to make homes and surroundings more resistant to fire.

The program helps homeowners understand more about how home construction and design, landscaping, and maintenance, and emergency response can all help in the event of a fire. It is a lot of work to define the community, create boundary maps, harden homes per the Calfire recommendations, and draw up a clear escape plan as a community. However, the benefit is that insurers will take this into consideration in the form of discounts when it comes to insuring a home. Once the new reforms come into place, it is homes such as those in Firewise areas, which will be the first to come off FAIR Plan, which is good news for those who have gone through the effort.

What Are The Steps That You Should Take As Part of Purchasing a Home?

The first thing to say is that if you are thinking about making an offer on a home, the first thing I always do is investigate the insurability. If you are going to be making an offer, especially in a competitive situation, you really need to do that upfront so that you don’t need to weaken your offer with an insurance contingency. The good news is that the recently revised purchase agreement now includes the ability to put in a specific insurance contingency so that if you aren’t able to complete the purchase by getting an “Acceptable” insurance quote, then you are able to break the contract without penalty.

The other thing to note is that sellers in very high fire-risk areas do have an obligation under AB38 and CalFire to provide some level of compliance with defensible space requirements. For example, I recently represented a client in the purchase of a home, and as part of the due diligence we got Calfire out to the home and made a report of the required Cal Fire home hardening recommendations. We then got a landscaper to provide a quote for undertaking the work and we were able to negotiate a $10,000 credit as part of the purchase price.

What About the Future? Is Insurance Going To Get Easier?

The good news is that there are reforms on the way which will make it easier to get home insurance without resorting to FAIR Plan in an attempt to break out of this cycle whereby the more people using FAIR Plan, increases the risk of financial collapse of FAIR Plan and so more and more insurers leave the state because they don’t want to be liable for their share of picking up the shortfall.

Before we talk about how the system is going to change, it is worth re-capping to how we got here. All California insurers, including the FAIR Plan, are restricted by regulations imposed in 1988 to control premiums.

These regulations place strict limits on the ability of insurers to increase premiums. For example, insurers are not allowed to include the cost of reinsurance in calculating their premiums which is clearly a significant expense. They also require that insurers set premiums based on historic claims data over the past twenty years rather than use forward-looking models that take into account the changes in building materials as well as sophisticated climate models to forecast damage from future wildfires, storms, and flooding.

In return for the Insurance Commissioner relaxing these rules, insurers will be required to write 85% of their policies in high-fire-risk areas. Once these changes come into effect, expected to be at the end of this year, then All State and State Farm will likely come back into the California market. While this is great news, what we don’t know is how much those policies will cost under the new rules insurers have for setting premiums. That being said, competition in a freer market can only be a good thing to both drive down prices and also reduce the overall number of people on the FAIR Plan.

The other thing worth noting is that once they do re-enter the market, these insurers have a list of all the Firewise communities so it is these homes that will be the first to come off the FAIR Plan which is definitely an incentive for communities to take part.

There will almost certainly be a price we will have to pay as homeowners. Currently, if the FAIR Plan's funds are depleted due to a massive event like a wildfire, it can place an assessment on insurance companies to bridge the financial gap. Previously, these companies had no direct way to recoup those costs, which is why so many companies pulled out.

Under the new agreement, insurance companies will have recourse. If the FAIR Plan levies up to $1 billion in assessments on insurers within a calendar year, they can request approval from the insurance commissioner to place temporary fees on their policyholders, recouping up to 50% of their assessment. If the assessment exceeds $1 billion, insurers can recoup 100%.

So the good news is that insurers will come back into the market, the bad news is that policyholders may just find that costs go up. However, surely it is better to be able to actually get insurance, even if it means we pay a slightly higher price.

The other change that is being made as part of these reforms requires the FAIR Plan to enhance its reporting and the provision of metrics to the public providing more transparency on the state of the market.

In Summary

In 2023 and 2024, insurance has become a really thorny issue for homeowners and especially home buyers. We have all gotten used to having to rely on coverage from the FAIR Plan if we can’t find a regular insurer. However, the outlook is better in that there should be an increasing number of companies to choose from when it comes to insuring your home.

What we don’t know yet is the impact that these new forecasting models will have on insurance premiums and of course, if there is a big event, then policyholders can expect a one-off charge. Regardless of all of this, if you own a home or are buying or selling a home you have a responsibility to both yourself and your neighbors to harden your home. While the link between a reduction in premiums and hardening your home or putting on a metal roof is still very opaque, the chances are it can only help you either come off the FAIR Plan or else reduce your premium over time as the competitive market finds its new normal.