Over the past month, I have started to have more and more conversations with both buyers and sellers about the market turning. I have

sellers asking if it is too late to “cash-in” and buyers downgrading their purchase price points as they look at their stock portfolios and see a sea of red. It’s too early to start making any doom and gloom predictions, but anecdotally things seem to have changed. The really telling thing will be to dive into the data for June which will be out in a few weeks, because June is the first month where I feel consumer sentiment will be reflected in some of the housing data. The May data is still showing a really strong market although there are a few tell tale signs when we look at some of the key indicators.

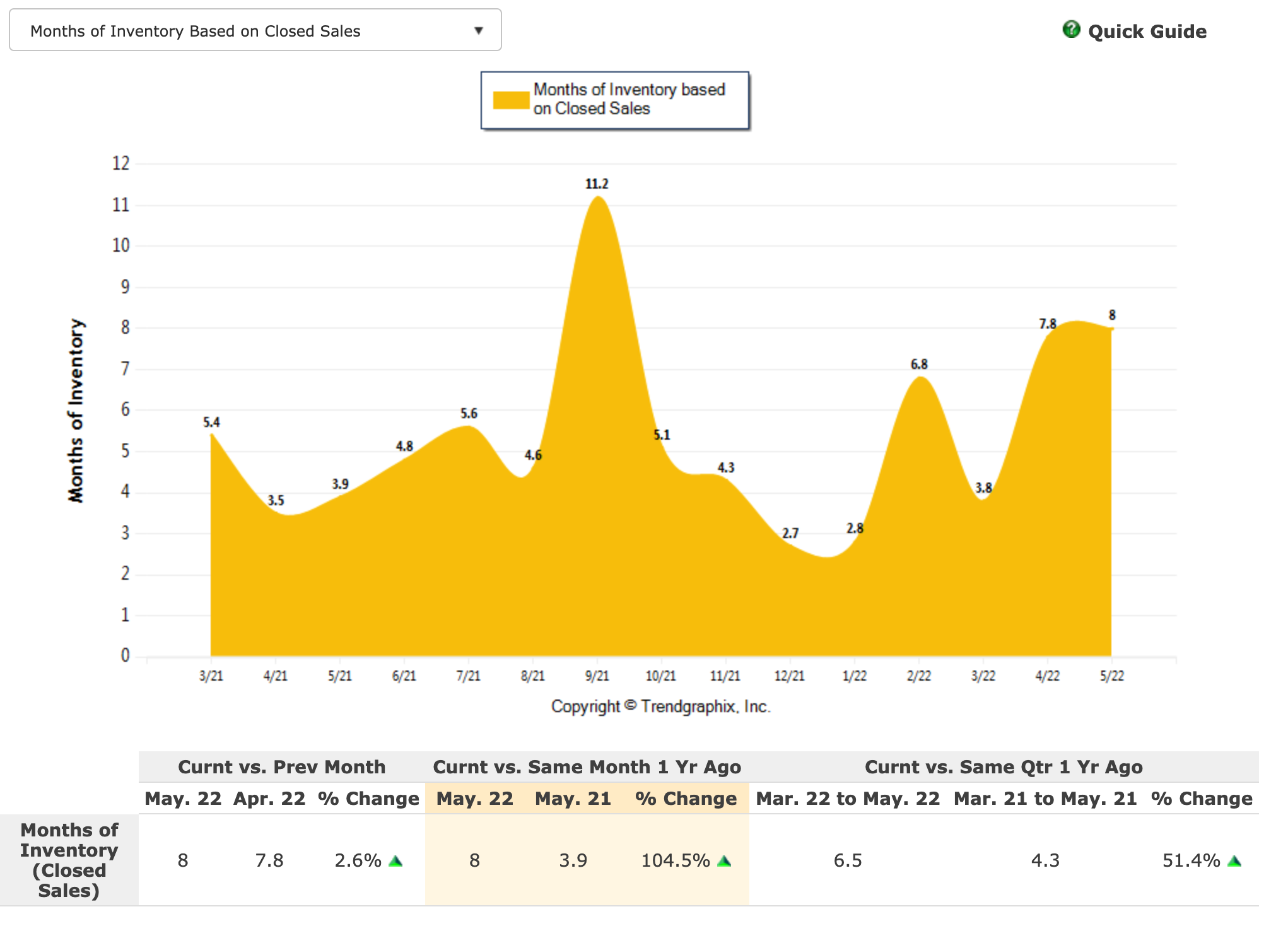

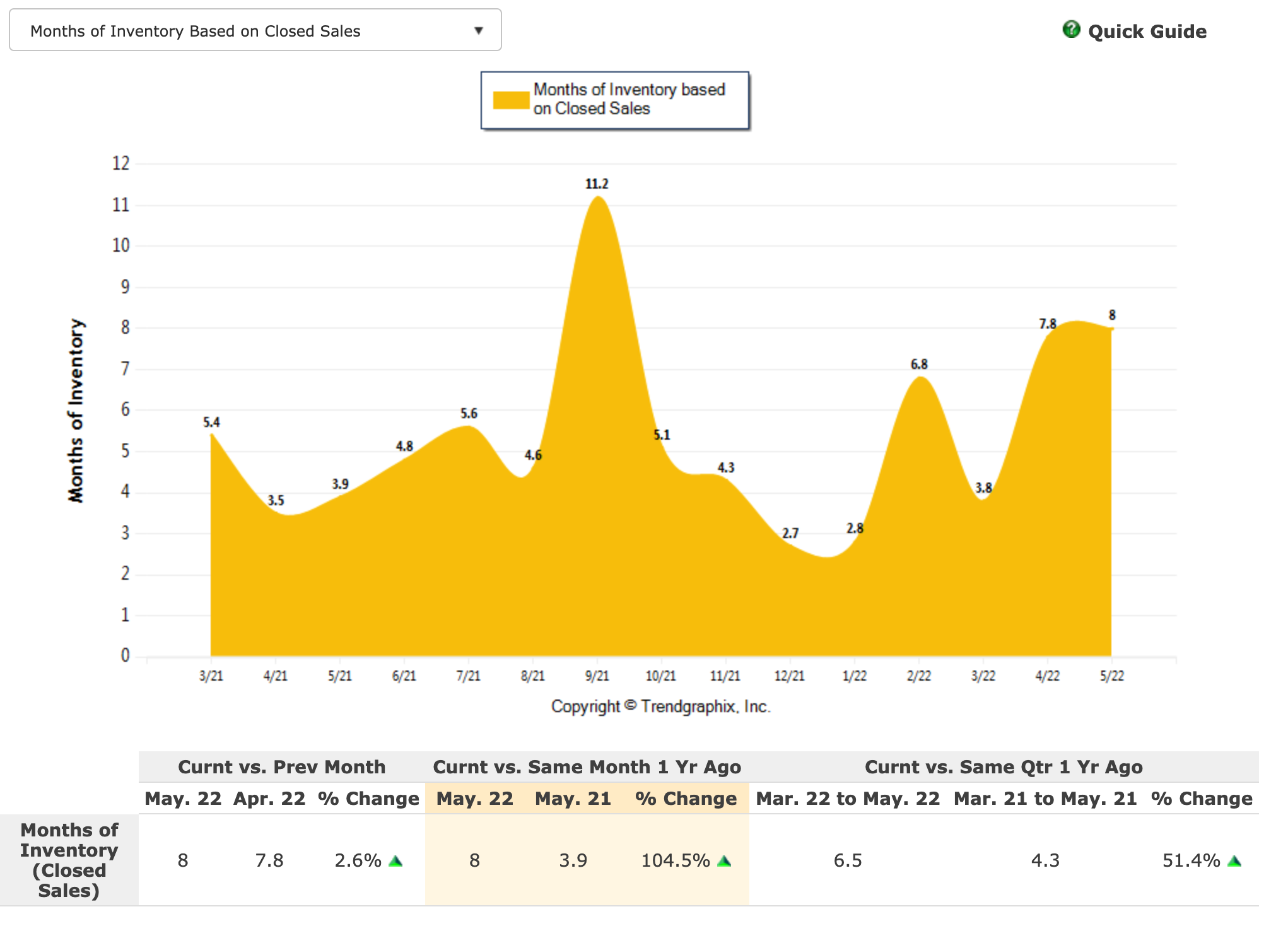

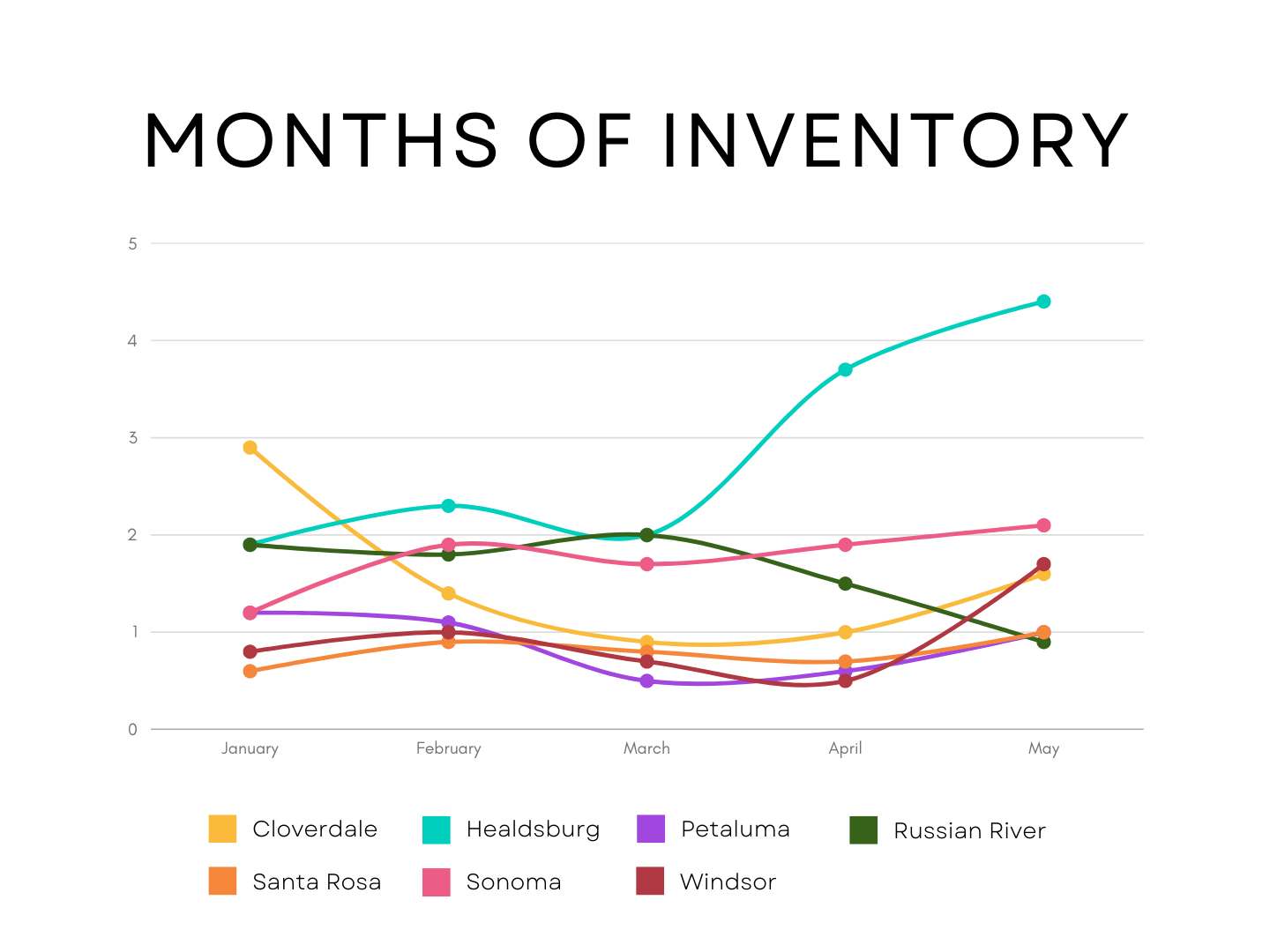

Inventory Levels

One of the key metrics for a market changing from a sellers market to a buyers market is the ‘Months of Inventory based on Closed Sales’. As a rule of thumb, an inventory level of less than three indicates a strong sellers market while an inventory level over six months indicates a buyer market.

If we look at Sonoma County as a whole, inventory sell through levels are still incredibly at 1.3. This means if no new houses came onto the market, all the inventory would be sold in 40 days. However, while this is incredibly low, it is the highest it has been in over a year and is definitely showing an upward trajectory.

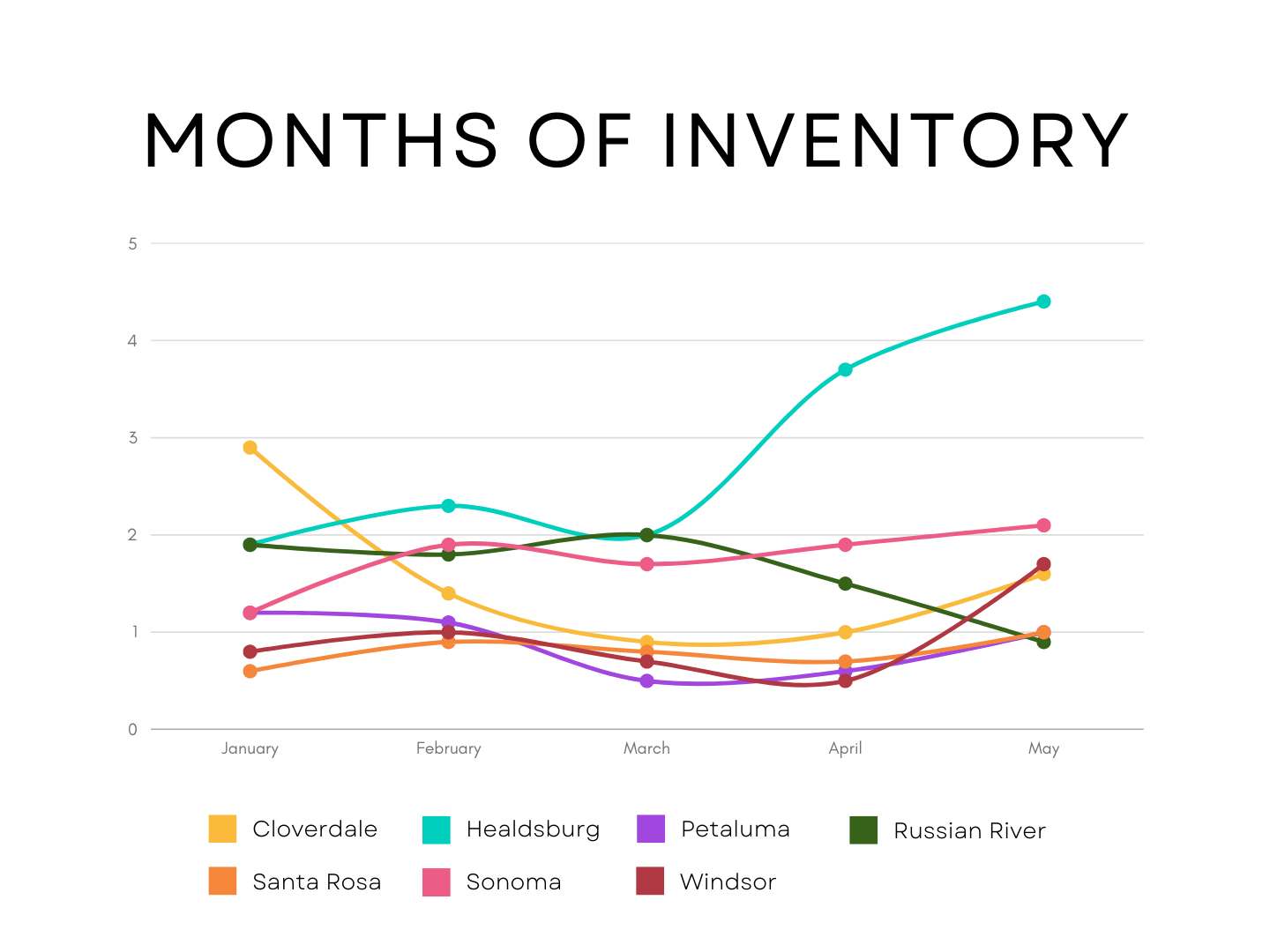

If we drill down into the data for Healdsburg, the market is fast heading towards being a buyers market with inventory levels at 4.4 months having risen sharply from being 1.3 months in December. If we look more specifically at the market for properties over $1.5m, inventory levels are at 8 months, well into the territory of being a buyers market (see chart below)

This data is definitely not a definitive marker and I am not sure why Healdsburg is the first market to show a dramatic increase in

inventory levels. However if we look across the key markets of Sonoma, Windsor, Santa Rosa, Cloverdale and Petaluma, the inventory sell through rates are increasing as can be seen from the chart below.

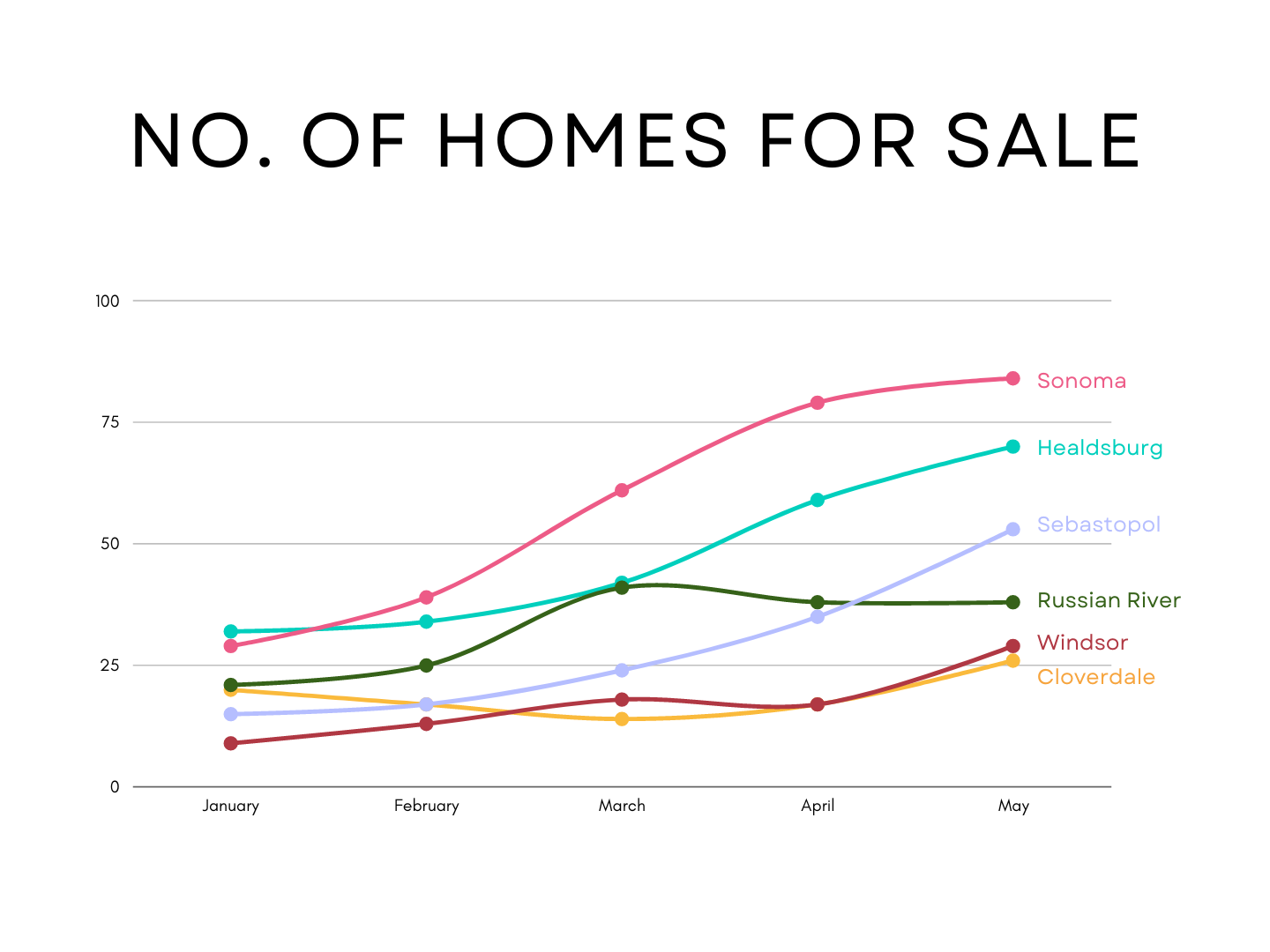

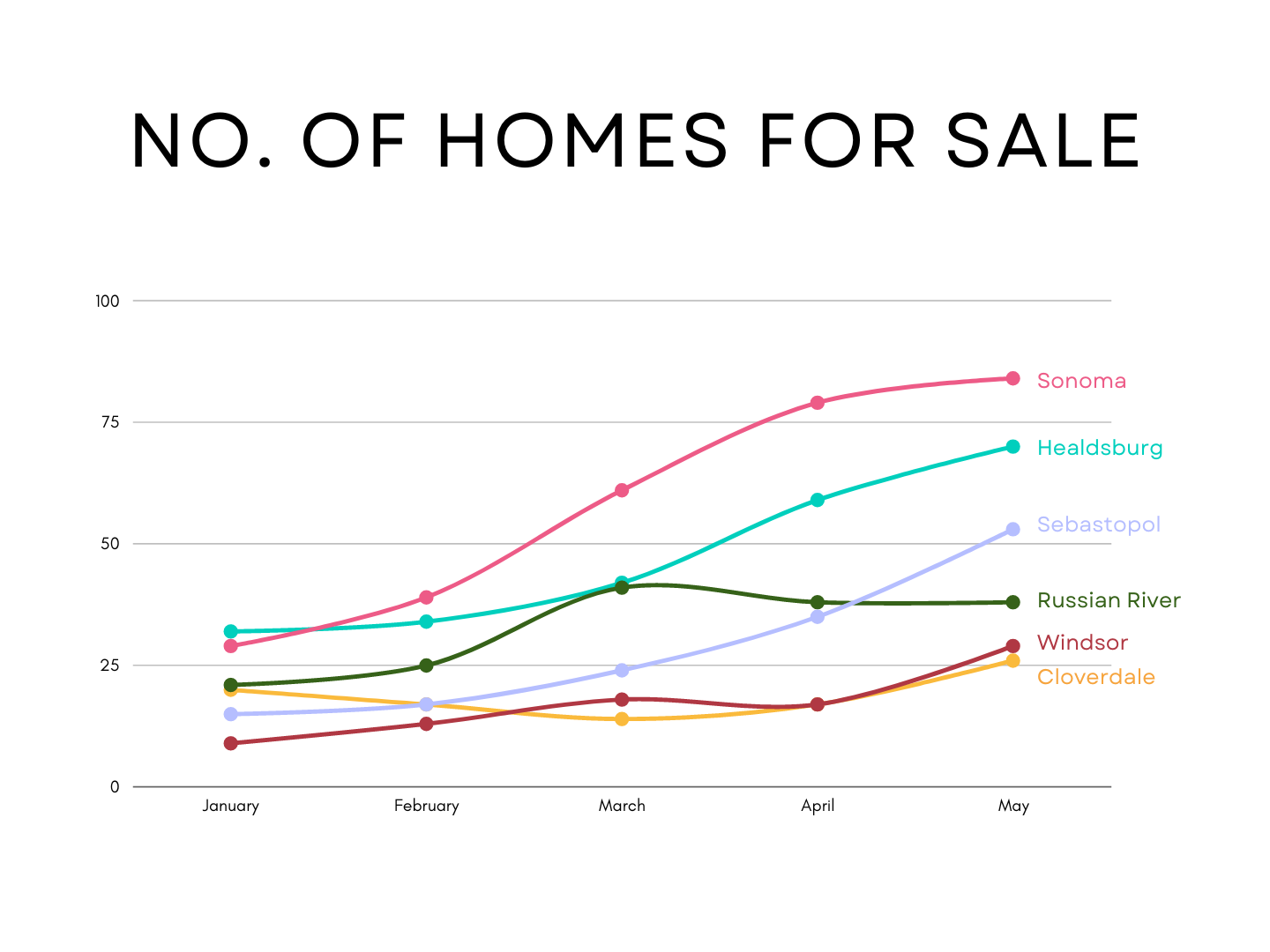

The other indicator as homes sit on the market for longer is the number of homes for sale increasing. If there was a high volume of new listings coming on the market, the rise in the number of homes on the market would be even more pronounced. However, a slow down in the number of properties coming on the market is making things look better than they really are.

Price Reductions

I have recently had a few clients asking me if there are suddenly a lot more price reductions. It certainly feels that way. I have a

dashboard that I view every morning that shows me the properties that are coming on the market as well as all the properties that have a price reduction or have come back on the market. Anecdotally, I certainly feel there are lot more price reductions, some of them pretty dramatic.

While it is not possible to compare for example how many price reductions there are in May 2022 compared to May 2021, I did find a hack that enables me to search on the number of price reductions that have taken place during a 30 day period. While I don’t have any comparative data the number is pretty alarming. From May 24th to June 23rd there were 269 price reductions. Bear in mind there were just 703 properties on the market which means that 38% of all homes on the market have had a price reduction. I have no idea how many price reductions

there were in May 2021 as a percentage of homes for sale but I would be amazed if it was more than 10%.

Seller Strategies

The May data is still showing the days on market data at record lows with the average across the county being 29 days, which with a 21 day escrow means homes are getting offers after one or two weekends on the market. Typically, the speed of these offers has been driven by agents, like me, putting offer deadlines on a property to create a sense of urgency.

Over the past six months, a huge percentage of properties have been marketed by sellers agents by listing the property mid week, setting an offer deadline for the Monday or Tuesday after the second weekend, and then using multiple offers to improve terms to the benefit of the seller.

Over the past two days I looked at every home that came on the market in Sonoma County and none of them have set an offer deadline. A tell tale sign that something out there has changed. For an agent selling a home, there is nothing worse than setting an offer deadline and then not getting any offers. In the last few weeks, this happened on a number of occasions. For example there is a home in Healdsburg, 620 Hidden Acres, which is a great home with plenty of room for a pool below $2m. It was bought to market with an offer date set after the second weekend and it go no offers. A month earlier, I am sure it would have got offers. It has now had a price reduction of $50k and has just gone into its second month on the market.

Change in Demand For Key Property Types

The big question is whether the demand has dropped off for certain types of properties. With Sonoma County issuing a ban on issuing vacation rental until May 2023, it would be strange if the demand for properties that are eligible for vacation rental permits did not drop off. As such, we recently showed 11020 Peaks Pike, Sebastopol to a few buyers. It check a lot of boxes. It has a secondary unit, it was newly remodeled, on a very private, rural lot and once the ban is lifted, it would qualify for a vacation rental permit. It was deliberately price low at just over $1m, however, it attracted nearly 10 offers once of which was over 50% over asking.

However, there are other properties, such as 1553 Rosewood Drive, in Healdsburg which is identical in almost every way to the listing I had at 124 Paul Wittke Drive. It is listed at the same price I sold mine for three weeks ago when I had multiple buyers prepared to offer and yet it is sitting on the market with the number of showings dropped right off.

Cash Buyers Are Still On The Look Out

Although there are numerous signs that the market is on the turn, there are still a lot of buyers out there with cash or who have funds in a 1031 Exchange account waiting to find a home for their money. Last week I put a $2.7m offer in on a property for a client which was all cash and received an offer on a listing from a 1031 exchange client for a $2.2m listing.

One Last Chance To Sell Your Home!

As long as sellers are realistic and don’t price their home the same way they would price it if they had put it on the market 6 months ago, it isn’t too late to sell. If you are planning to sell your home anytime in the next four or five years, now is the time. If you plan to hold onto it for longer than that then you will likely be able to ride out this speed bump in the property market.

It’s not going to be anything like 2008 but even if prices flatten off, when you are used to price increases of 25% year on year it will certainly feel like prices are falling. Just because there is so much money in the Bay Area, I think the higher end will likely be pretty well insulated. It is the lower end, sub $1m, which is likely to be hard hit as inflation and interest rates really stretch household budgets.