This month, I sat down with Robert Stroud of Farmers Insurance to reflect on the last couple of years and the impact of the fires on homeowners insurance as well as those looking to buy or sell a home in Sonoma County.

With the Tubbs fire affecting over 5500 structures and with estimated insurance loses of between $7.5-$9.7bn, it stands to reason that it has impacted insurance costs. The impact of the Kincaid fire has been a little different. With the 2017 fires still strong in the memory, it has caused people to stop and think more deeply about the reality of living with the ongoing threat of wildfires. In the short time since then, conversations with my clients have ranged from “it’s just something we need to live with” to “it’s made me realize I need to put in back-up power systems” to the most extreme example where a client who purchased a house just before the fires called me to say, “we’ve made a mistake buying a house here, so we would like to sell it”. However, the most common question concerns the impact on insurance and safety in general.

Rob Stroud has a team of five people and is one of the largest Farmers Insurance franchises in the Sonoma County so he is living the impact through both his business and in his dealings with clients day in day out.

I started out asking him how he got into the insurance industry:

I have always had a strong entrepreneurial drive and so I liked the idea of betting on myself and building a business where I was in control of my own destiny. I ended up at Farmers for a couple of reasons. Firstly, you really do own your own business but secondly, with Farmers, I am not forced to only offer Farmers Insurance. I can broker my own business which enables me to provide a more complete service to clients, although I will always provide Farmers with the first right of refusal before going elsewhere.

How have the recent wildfires impacted insurance costs?

Although you will hear of people who have had their household insurance costs increase, insurance companies can’t just raise rates. In order to raise rates, insurance companies need prove to the insurance commissioner that a particular home is at more risk. So what has happened is that a large number of houses are now deemed to be riskier to insure than they were prior to the fires and so have now have higher premiums.

Who decides the risk profile of any particular property?

Insurance companies now use an algorithm which allocates a FireLine score on a scale of 0 to 30 for every home. The score is a measure of the risk of the home from wildfire based on three factors, with zero being the least risky and 30 being the most:

- Fuel: How much fuel is in close proximity to the property. Grass, trees, or dense brush feed a wildfire.

- Slope: Steeper slopes can increase the speed and intensity of wildfire and thereby the risk.

- Access: Limited access and dead-end roads can impede firefighting equipment and so increase risk.

How can people find out what score their home or prospective home has?

I’m afraid these scores are not made public. The only way to find out the FireLine Score for a particular address is to ask for a quote from a broker.

(I have done some research into this, and there is fairly broad criticism of the insurance industry in general for not making public this data with some accusing insurance companies of deliberately using a proprietary system from a private company that is not transparent to further their own end. As with most things, it wouldn’t surprise me if technology found a way to disrupt the stranglehold that Verisk, the company behind FireLine, has on this market. For now, if you want to know the FireLine score for your property, contact your broker or else Robert would be happy to help you out).

What FireLine Scores are insurable with a regular premium?

Any score less than 3 (which covers the vast majority of homes) will be able to get a standard policy. Any higher than that and you are looking at alternative options.

What if I can’t get coverage from an insurance company?

The great thing about working with us is that if Farmers can’t insure it, we have other organizations we work with who we can generally get a quote from. However, we need to be realistic that for some homes, it will not be possible to get comprehensive coverage.

What should homeowners do if a home isn’t insurable?

My honest advice is, don’t buy the home. I say to all clients, don’t fall in love with a home before you have determined if we can insure it. That being said, if you are in a home that falls into a FireLine area that is not insurable then there is a back stop, FAIR Plan policies, which were introduced in 1968 by the California legislature. However, a FAIR Plan policy really is a very basic policy, a policy of last resort, and has a maximum combined limit of $1.5m so is not suitable for a lot of homes in our area.

What advice would you give to homeowners?

There are a few things that homeowners can do to help minimize the cost. I now always recommend that homeowners specify a deductible of $5000. It is also worth considering putting all your insurance business with one firm. I am not just saying this because its good for business but because you will get significant savings. For, example, for any combination of earthquake, auto and home you will get a 25 per cent reduction, if you combine life insurance and home you will get 5%. There are also good reductions for public service workers such as teachers and firefighters.

Are there other things homeowners can do?

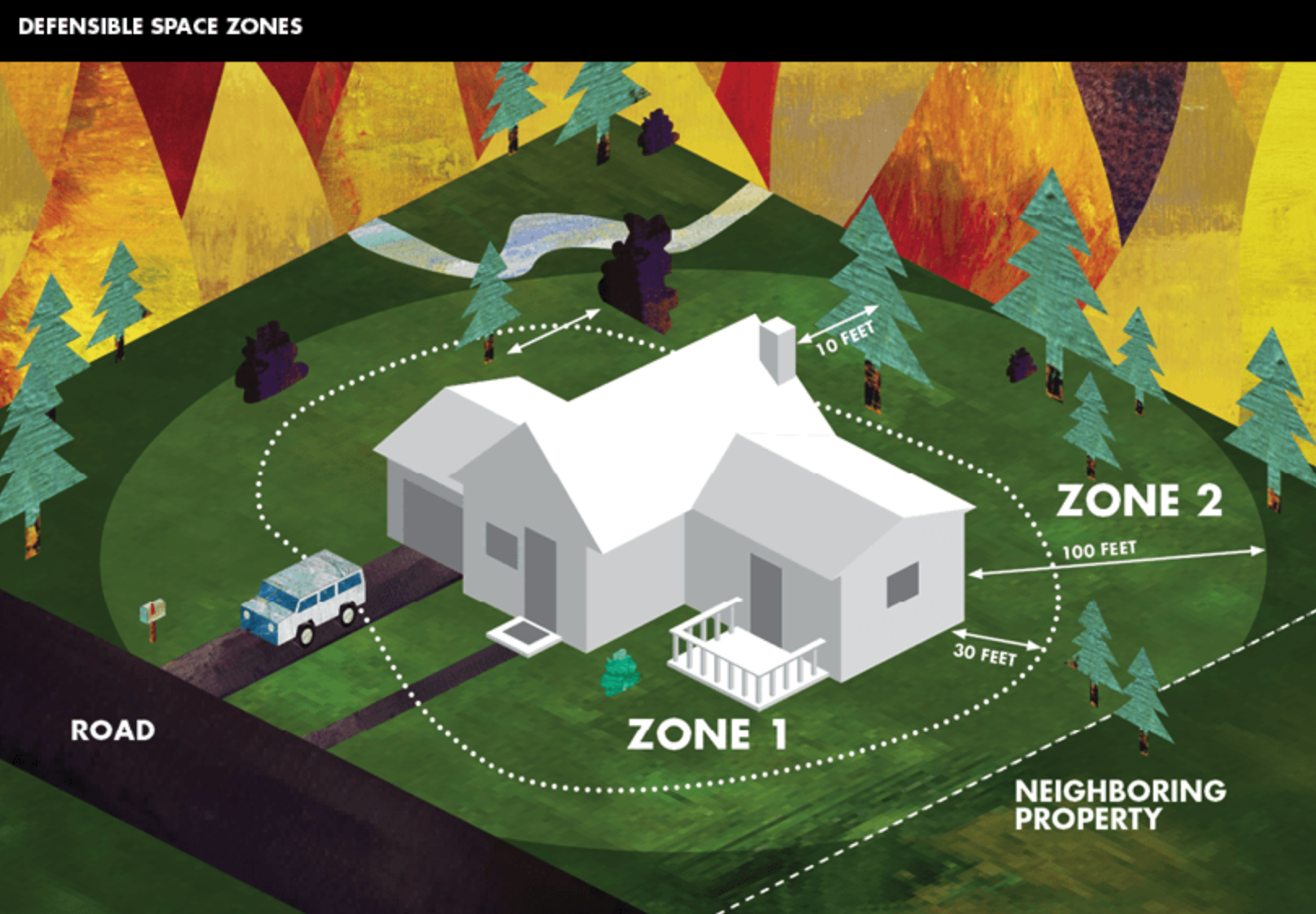

Given the factors used to assess risk, it is important to take care of the outside of the property. We visit every property we insure so we can share best practice with all our clients. The key thing is to make sure you keep brush trimmed back, plant California native plants which are generally more fire resistant, and get rid of plants such as ivy which are so invasive. (Check out this post for more information)

What do you think the future holds for insurance in Sonoma County?

As well as risk maps being re-drawn, we are already seeing a number of insurers leaving the state such as Liberty and CES. However for companies like Farmers that is 100% committed to California, I think it is only a matter of time before we see Fire insurance going the same way as Earthquake insurance in that it will sit outside of the regular homeowners policy.

If there are three questions people should ask their insurance broker, what would they be?

How did they perform in the 2017 and 2019 fires? In other words, what was their record in paying out. Who is their contact and did they get a proactive personal phone call on the day of the fires? Do you have to provide a list of contents for the insurance company to pay out on contents insurance?

With 180,000 people having to evacuate the costs of hotels can get very expensive if you have nowhere to go.

Does Farmers pay for costs associated with being evacuated?

Absolutely. Better than that, it is outside of the deductible and doesn’t count as a claim with regard to your premiums. For example, I had one client who had to evacuate his entire family and we paid an $18,000 bill for the family to stay at a resort hotel in Napa. When you are concerned about your house, the last thing we want our clients to worry about is where they are going to stay and how they are going to pay in the event of evacuation. Our whole business is about providing clients with great service and above all peace of mind.

If you want more information about Farmers Insurance, or would like Robert and his team to provide you a competitive quote call 707 546 2010