$1m+ Housing Market Weakens Through 2019

As we move into 2020, the macro economic factors that point towards a continuing of the strong property market are all positive: low interest rates, consumer confidence indices and a strong stock market which typically climbs 10% in a presidential election year.

However, for the first time in a long time the property market stalled a little in 2019. The $1m+ property market definitely weakened, while the lower end of the market largely maintained its 2018 performance. To understand the full story, I analyzed all the data from house price sales across Sonoma County for 2019 versus 2018 looking at the key indicators: overall sales volume, the sale price to list price ratio, the average sale price of homes, the average price paid per square foot and the amount of time it takes to sell a property. So let’s take a look at each of these in turn for Sonoma County overall, the sub $1m market and then the luxury $1m+ market.

Sales Volumes

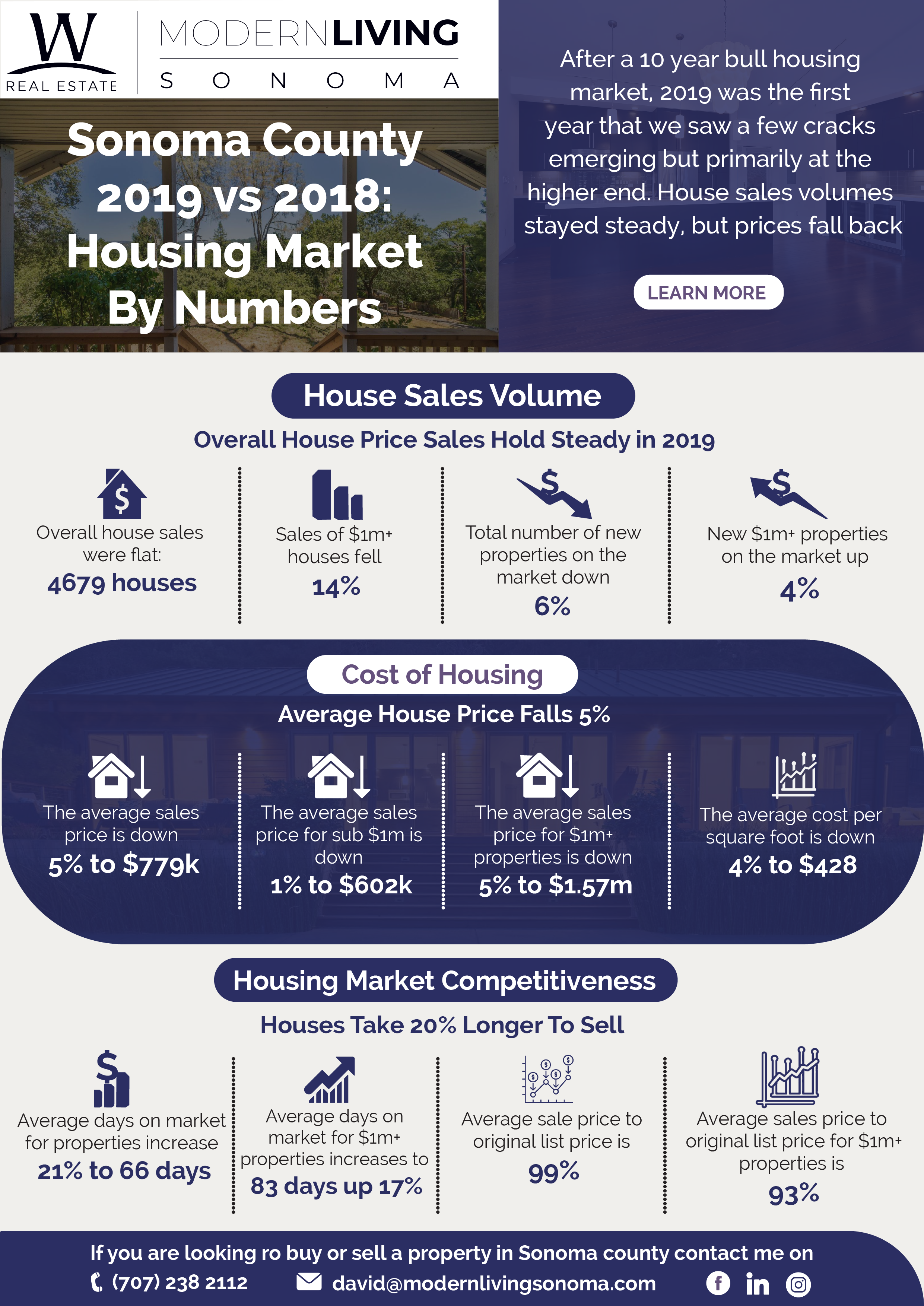

Overall the number of houses sold during 2019 when compared to 2018 was very similar although it did show a small fall of less than 1% to 5712 houses sold. However, if we look at the lower end and the luxury market separately, the stories are very different. Sales of properties for less than $1m actually increased in 2019 by 2% up to 4015, whereas the sales of $1m+ properties actually fell by 14% year on year. Because the large sales volumes are at the low end, this sharp fall in the sales of luxury properties has not impacted the overall market volume too heavily.

What is interesting is that the number of new listings coming on the market was down by 6% overall but was up 4% at the top end of the market. My theory is that this is down to two factors: firstly, overall house price increases through a bull market means that year on year there are more properties that fall into the $1m+ category and secondly, because of this bull market, it has triggered a number of people with $1m+ properties to realize some of the their gains.

Sales Prices

This is the stat that everyone most cares about. Is my house worth more or less than last year. The answer is always, it depends on the property although there are clearly macro trends that all properties are subject to. The average house price has fallen 5% year on year from $737K to $779. However, looking at the data, it is the higher end of the market that has felt the biggest impact with properties selling for less than $1m falling by just 1% to $602k whereas higher end properties have fallen 5% down to an average of $1.57m. The higher end of the market has actually distorted the overall market because of some of the large falls at the top end.

House Price Competitiveness

There are two factors that indicate how competitive a market is and whether it is sellers or buyers who hold the cards. Firstly, how close are actual sale prices to list prices and secondly how long it typically takes to sell a property? What is interesting is that overall properties are still being sold for 99% of the list price. However, if we look at sales price against the original list price it is 97%. In other words most properties are being sold at a 3% discount to list price. In 2018 properties were being sold at asking price which represent 98% of the original list price. The big difference in 2019 is that we have seen a lot more price reductions prior to the sale. As with all of the data, it shows that the higher end has performed less well in 2019 with the average sale price to final list price being 97% and 93% when compared against the original list price.

Summary

Finally, does it take longer to sell a house in 2019 compared to 2018? The answer across the board is a strong ‘yes’ indicating a shift in the market towards the buyer through 2019. Overall properties are taking 21% longer to sell at 66 days. It is worth noting that this includes the escrow period which will typically be 30 days, so in reality it means most properties are getting an offer accepted after 5 weeks. At the higher end of the market for properties over $1m, it is now taking on average 83 days to sell.

In Summary

2019 has seen the market weaken for the first time in many years with the higher end of the market being most badly impacted. This also means that for the first time in a long time, the balance of power has tipped towards the buyer. While history would expect the weaker high end market to trickle down across the entire market in 2020, with the core fundamentals still being strong this year may prove the exception. Through 2020, I would expect the market to continue along its current path with a weaker higher end market but the core market largely holding steady.